There are several tools out there that you can figure out holiday pay for everyone on your team — including doing it manually — but we (biasedly) recommend Hubstaff.

Calculating holiday pay is complicated, but don’t let that stop you from offering holiday pay for your team. Your company’s holiday pay policy is critical to your team’s satisfaction, but you don’t have to do it alone. Hubstaff can help you offer holiday pay without extra work.

Hubstaff is a robust timesheet software and payroll solution for any sized business. Hubstaff tracks your team's time and productivity and makes it easy to pay everyone for all their hard work at the end of the pay period.

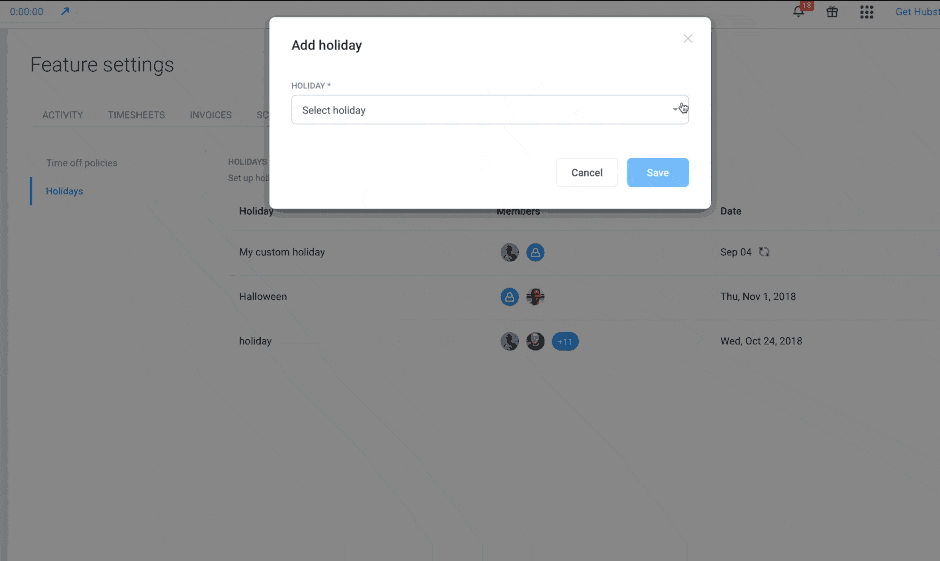

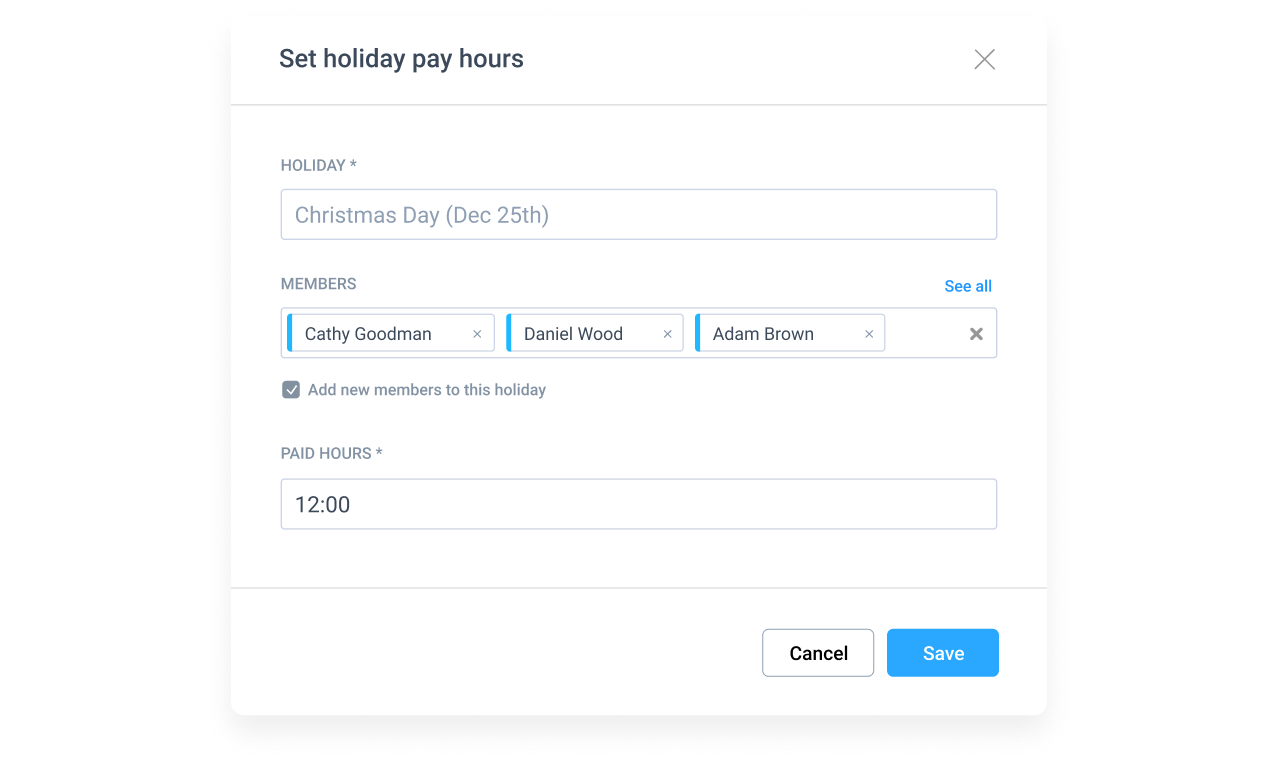

Hubstaff also makes holiday pay super simple. With our easy-to-use app, you can create single or recurring holidays for your business and choose who can bill during them. So, if you manage both full-time staff and contract roles, you can select who's eligible for holiday pay.

Additionally, you can easily set a holiday pay rate, so if you decide to give your team time-and-a-half for the holidays, Hubstaff will automatically pay them for those set dates.

Once you’ve set that up, you can update your employee schedule within Hubstaff so you’ll know who’s working over that holiday or on vacation. Learn more about Hubstaff’s scheduling feature.

Hubstaff wants to ensure paid holiday time is simple enough so you, too, can enjoy the holidays without worrying about whether your team will receive holiday pay.

Important Notice: The information in this article is general in nature and you should consider whether the information is appropriate to your needs and federal law in your region. Legal and other matters referred to in this article are of a general nature only and are based on Hubstaff’s interpretation of laws existing at the time and should not be relied on in place of professional advice. Hubstaff is not responsible for the content of any site owned by a third party that may be linked to this article, and no warranty is made by us concerning the suitability, accuracy, or timeliness of the content of any site that may be linked to this article. Hubstaff disclaims all liability (except for any liability which by law cannot be excluded) for any error, inaccuracy, or omission from the information contained in this article and any loss or damage suffered by any person directly or indirectly through relying on this information.