There are many methods for calculating timesheet hours, but they all start with employees logging their time on tasks and projects. Their logged hours can be either dedicated to a specific project or can count for the total hours that a team member has spent working for a particular company within a period.

You can track time by filling out paper timesheets, punching time cards, or using timesheet software. Today, most companies use digital platforms to track hours.

Time clock apps have several benefits over old-school time cards, two of the most significant being improved accuracy and ease of use. Employees can manually enter the employee hours in a timesheet at the end of each day or use a time tracking app to track time on the go.

If your system is analog, you can use free timesheet templates and a time card calculator to save time and improve the accuracy of your calculations.

You have to decide how to add up hours for payroll, and there are two primary ways to go about doing that:

1. Actual time calculation

Use the time an employee has recorded (e.g., if they noted 5 hours and 13 minutes, use this number for their payroll). You can calculate based on the hours worked but must ensure that your time tracking solution allows it.

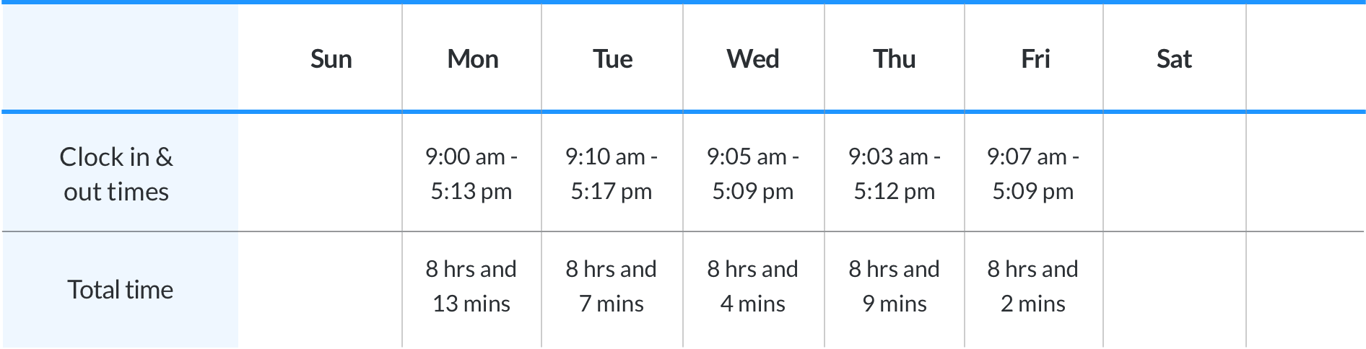

This is how the calculation works:

40 hours per week.

Then, you have to add the minutes. In this case, 13+7+4+9+2 = 35 minutes

The total hours for the week are 40 hours and 35 minutes. This addition is correct, but you cannot use it for payroll calculation, as the time is not in decimal format.

2. Rounded time calculation

Now that you've totaled the hours, it's time to round to the nearest hour (also called timesheet rounding). Before you start, make sure to subtract any unpaid breaks and lunchtime.

While the practice of timesheet rounding is legal under federal law in the U.S., you must follow strict rules regarding how you apply it in your payroll calculations.

Here are the rules to follow:

:00, :15, :30 and :45.

If an employee clocks in or out at a time that doesn't match the 15-minute intervals, round to the nearest one, either up or down.

Use the 7-minute rule when rounding:

Examples of rounded time calculations:

The logged time is 9:07 am. You have to round down to 9:00 am.

The logged time is 9:08 am. In this case, you have to round up to 9:15 am.

After rounding up or down, you subtract the clock-in time from the clock-out time to obtain the number of hours and minutes that an employee worked during a specific day.

Let's say the person clocked in at 9:08 AM, rounded to 9:15 AM, and clocked out at 5:28 PM, rounded to 5:30 PM.

Follow these steps to get the payroll calculation right:

First, convert all hours to 24-hour format, so 5:30 PM becomes 17:30.

Then you subtract 9:15 from 17:30, and the result is 8:15.

This means that the employee worked 8 hours and 15 minutes.

Convert the time into a decimal format before you use it for payroll calculation.

You can also use other rounding options, such as 5-minute or 6-minute. In both cases, the rounding should be up or down, depending on whether the logged time hits the half-interval mark.

The guiding principle for your rounding system is that it should never harm the interests of your employees. Failing to protect their right to fair payment can result in wage theft accusations and trials.

You can set up rounding only in your employees' favor, but you cannot always round time legally in your interest. A tried-and-true way you can opt for is to round the clock-in time in favor of the employee and the clock-out time in your favor.

Whichever method you choose (actual or rounded hours), remember that if an employee has worked more than 40 hours per week, you are legally responsible for overtime pay. It's typically 1.5 times the regular wage rate per hour. There may be other cases where you use the overtime rate, such as weekend working hours or other special occasions.