Construction overtime is the pay given to employees for every hour they work over 40 hours a week. It’s federally mandated and must be paid at 1.5x the worker’s typical hourly rate.

If you run a construction company, you’re probably well aware of overtime pay. It’s something managers and owners try to avoid at all costs.

The reason for this is simple: every hour of overtime worked means 50% higher costs and lower profits.

What’s more, labor laws are complicated, and many construction firms fail to comply with every aspect of them. This means being at risk of fines or even imprisonment for failure to comply.

Just recently, a filing has been made against a stadium subcontractor in Nevada who has repeatedly been violating the Fair Labor Standards Act (FLSA). Since 2010, Nevada has recovered over $19 million from 1,615 companies that violated the FLSA.

Thankfully, there are several ways to reduce your overtime bill (or eliminate it) and fully comply with the law. We’ll break these down below.

See Hubstaff in action

Watch our interactive demo to see how Hubstaff can help your team be more productive.

What are the construction industry overtime rules?

The federal government mandates that overtime be paid to all non-exempt employees working over 40 hours per week. Every hour of overtime worked is paid at 1.5x the worker’s typical hourly rate — it’s that simple.

Which construction workers are exempt from overtime?

The only workers exempt from overtime entirely are independent contractors.

The law doesn’t classify independent contractors as employees, and you’re not required to pay them overtime.

However, there are two downsides to using independent contractors:

- They are often more expensive per hour compared to employees.

- The federal government is taking a harder stance against companies that use contractors instead of hiring employees.

Construction companies using independent contractors often treat them like employees. This is against the law.

Contractors are entitled to different working practices compared to employees, and all construction companies should be aware of this.

Failure to differentiate these two roles means risking a fine.

In 2019, a construction company in Florida had to pay over $178,000 in back pay for violating overtime rules and misclassifying workers as contractors.

High-level employees aren’t exempt

It’s important to know that, unlike other industries, construction is not able to benefit from the FLSA Section 13(a)(1) exemptions.

This section relates to employees who meet certain requirements and are paid the equivalent of more than $684 a week.

In the construction industry, overtime applies to any worker, no matter how much they are paid or what their position is.

This means that overtime pay applies to all of your construction employees.

Check-in with your state laws

Don’t forget to reference your state’s specific regulations around overtime pay.

Some states apply overtime provisions to certain industries or have different rules for exemptions.

Hawaii, for example, states that an employee earning more than $2,000 on a monthly basis — guaranteed — is exempt from the state overtime law.

That said, you should always consult a professional before making payroll decisions, as they’ll know your business, employees, and state laws.

How to calculate construction overtime

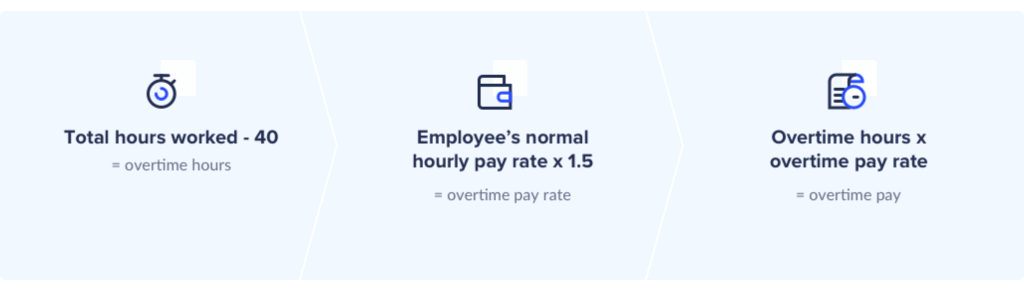

When it comes to calculating overtime pay, follow these steps.

- First, add up the total hours worked for that week for one employee. If you recall from above, any hours over 40 per week for non-exempt employees are considered overtime. Subtract 40 from the total number of hours to get the number of overtime hours.

- Then, take that employee’s typical hourly rate and multiply it by 1.5.

- Finally, you’ll multiply that new hourly rate by the number of overtime hours to see how much you need to pay them.

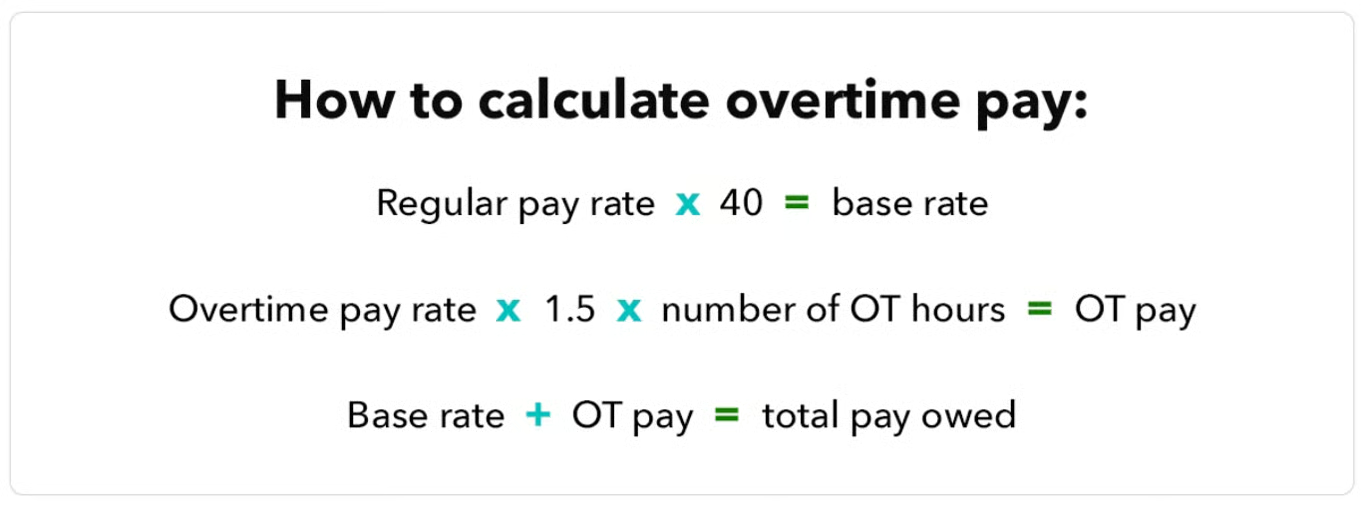

Here’s an example of how this might look if an employee works an extra 15 hours one week.

- 55 (total hours worked) – 40 = 15 overtime hours

- $17/ hr (employee’s normal hourly rate) x 1.5 = 25.5

- 15 (overtime hours) x 25.5 (overtime pay rate) = $382.50

Calculating overtime for different types of construction workers

While overtime is a mandatory law covered by the Fair Labor Standards Act (FLSA), different types of construction workers may see differences in their overtime wages.

As soon as they have two or more employees, companies will start to notice how overtime pay can vary. For example, take the two charts below. As you can see, both California workers clocked in 50 hours in a week at the same rate, but their differing schedules led to different pay at the end of the week.

| Monday | Tuesday | Wednesday | Thursday | Friday | Weekly total | Pay totals | |

|---|---|---|---|---|---|---|---|

| Total hours worked | 10 | 10 | 14 | 8 | 8 | 50 | |

| Regular pay hours ($20/hr) | 8 | 8 | 8 | 8 | 8 | 40 | $800 |

| Overtime ($30/hr) | 2 | 2 | 4 | 0 | 0 | 8 | $240 |

| Double-time ($40/hr) | 0 | 0 | 2 | 0 | 0 | 2 | $80 |

| Total | $1,120 |

| Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | Weekly total | Pay totals | |

|---|---|---|---|---|---|---|---|---|---|

| Total hours worked | 4 | 4 | 4 | 6 | 4 | 14 | 14 | 50 | |

| Regular pay hours ($20/hr) | 4 | 4 | 4 | 6 | 4 | 8 | 8 | 38 | $760 |

| Overtime ($30/hr) | 0 | 0 | 0 | 0 | 0 | 4 | 0 | 4 | $120 |

| Double-time ($40/hr) | 0 | 0 | 0 | 0 | 0 | 2 | 6 | 8 | $320 |

| Total | $1,200 |

Overtime calculation for skilled vs. unskilled labor

In addition to scheduling differences, skilled and unskilled labor could cause discrepancies in overtime pay. For instance, some companies may choose to pay “unskilled labor” the minimum amount of overtime possible. Due to the company’s dependence on their willingness to accept overtime, more skilled laborers might receive the added incentive of double-time pay.

We don’t necessarily condone paying minimum compensation for overtime and aren’t huge fans of the term “unskilled” laborer. However, in this instance, an “unskilled” laborer would make the minimum legal overtime pay requirements, or what’s known as time and a half:

Pay rate x 1.5 x number of OT hours = OT pay

Source: QuickBooks Blog

What about for highly compensated employees?

For highly skilled workers earning double-time pay, you’d simply increase the 1.5 multiplier to double the pay:

Pay rate x 2 x number of OT hours = Double-time pay

Considerations for overtime in union vs. non-union construction projects

Another interesting wrinkle with overtime pay is union contracts. While non-union construction workers are typically only entitled to time and a half after exceeding 40 hours, union contracts may have different specifications.

For instance, maybe a contract specifies overtime takes effect after exceeding 35 hours of work in a given week instead of 40. Maybe it explicitly states double-time pay as the established overtime rate. In fact, union workers are about ten times more likely to receive double-time pay than their nonunion counterparts.

How to reduce or eliminate construction overtime

The potential of paying 1.5x pay for additional hours of work is not one that most construction company owners or managers want to entertain.

Thankfully, there are several ways to lower or eliminate overtime.

1. Reduce overtime by using contractors

Bringing on contractors can help you reduce overtime pay by allowing you to scale up your workforce when you need to. They can slot into your site and take on time-consuming tasks that would push your full-time employees into overtime territory.

Bringing on subcontractors to tackle a specific part of your build (e.g., electrical, concrete, or drywall) can save you from overtime expenses. However, you should be ready to pay specialists for their expertise.

Remember: contractors are subject to different rules compared to employees, and you must treat them differently.

Fail to do so, and you may end up facing fines.

2. Eliminate overtime with temporary workers

Using temporary workers that you can pull in at short notice can help you eliminate overtime costs.

Temporary workers can be as skilled as your current employees and can take up the additional responsibility of completing tasks and jobs on-site. Usually, temp workers are available at the same or similar rates of pay as your employees.

They can take on tasks that your current employees aren’t skilled at doing, aren’t able to do, or don’t have the time to do.

If you’re thinking of using temporary workers, start now by building up a network and a contact list of workers who are available for short notice and short-term work.

3. Track work hours better with GPS construction time tracking software

It’s easy to unexpectedly reach overtime hours when you’re only getting timesheets at the end of a pay period.

On the other hand, if you’re constantly up-to-date on everyone’s hours and can see how much of the project budget has been used, it’s much easier to adjust the schedule.

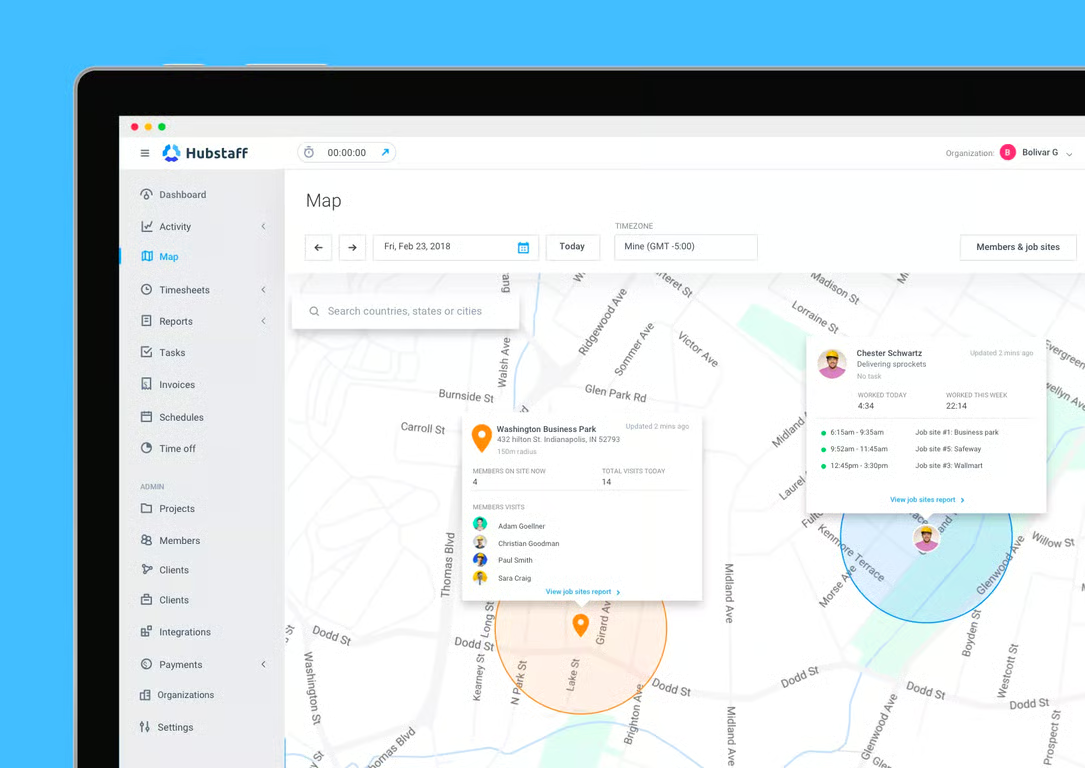

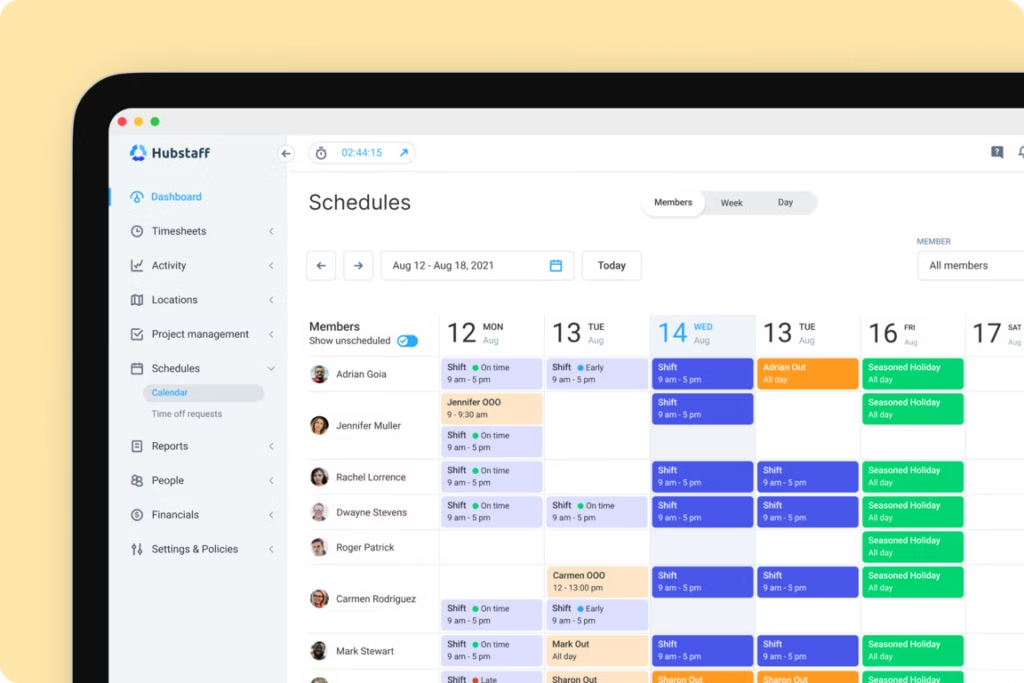

Tools like Hubstaff’s time tracking with geofences for construction make it easier to understand what your employees are doing throughout the day by sending daily time cards straight to your inbox.

Running as a lightweight app on your team’s mobile devices, Hubstaff accurately tracks hours and locations throughout the workday. You can see where your crews are, how much time has been put into a project so far, and even when they’re in transit to get more supplies.

Hubstaff allows you to automate the clock-in process by setting up digital geofences around your various job sites. When someone enters or leaves a job site, time tracking automatically starts or stops. It’s that easy.

One construction company, Everbuild, uses Hubstaff to reduce the amount of time they spend tracking down crews and their time cards. This helped Everbuild to streamline payroll and eliminate the time-consuming process of reporting hours.

4. Cross-train your employees

Once you’ve implemented Hubstaff time tracking to track crews and their shifts, it’ll be easier to identify who has more time and who has a full schedule.

For those who have more availability, take advantage of cross-training so they can jump into other roles as needed.

The benefit of this is that you can reassign tasks when you need to and prevent overtime hours.

For example:

If your roofing team can work 30 hours a week and get their tasks completed properly and on schedule, each employee will have a spare 10 hours per week they can spend on a second project at the same site. Or, they can drive over to help with another job.

These surplus 10 hours per week are paid at the standard hourly rate and mean you are no longer required to pay an extra 50% for employees to complete the tasks using overtime.

Legal Implications of Incorrect Overtime Calculation

While overtime calculations are fairly straightforward, mistakes do happen. If you’re managing a large construction team, looking to cut costs, or simply concerned about compliance, it’s best to look into the consequences of incorrect overtime calculations.

Potential Penalties for Non-Compliance with Overtime Laws

According to the FLSA, construction employers in violation of minimum wage or overtime laws can be fined a penalty of up to $1,000 per infraction.

Interestingly enough, even unauthorized overtime must be paid to employees. Of course, employers are encouraged to implement policies for unauthorized overtime that involve fines, termination, or other repercussions. Furthermore, employees are entitled to sue an employer who violates their right to overtime compensation. If you’re looking to cut overtime costs, we can’t stress enough the importance of overtime compliance.

Best practices for managing construction overtime

Now that you understand the legal repercussions of overtime compliance issues, it’s worth exploring some strategies to help you keep overtime costs to a minimum. First up, some proactive strategies.

Proactive strategies for minimizing overtime

- Treat overtime as an exception. This is a great piece of advice from the When I Work blog. If you’ve established a culture where overtime is the norm, you’re harming your employees’ work-life balance and your bottom line.

- Limit overtime. Setting the maximum amount of overtime an employee can take is also a great way to protect the mental health of your employees while also saving money. It’s a win-win.

- Improve shift scheduling. Optimize your shift scheduling to avoid mistakes that result in overtime. Make sure you have full coverage so that you aren’t doling out overtime pay to make last-minute corrections.

- Better understand overtime use cases. Using a time tracking tool is a great way to understand when and why overtime becomes essential in the first place. Learning from this time tracking data can help cut costs.

Of course, these strategies are useless without putting proper training in place.

Training managers and supervisors in overtime management

Having adequate best practices in place needs to start at the top, but it also needs to trickle down to all managers and supervisors at the company. Otherwise, you’ll be forced to micromanage in order to ensure compliance with your policy — which, ironically, might leave you racking up overtime hours yourself. That said, it’s also hard to find the time to train employees on managing overtime. Fortunately, companies like SHRM offer courses on using overtime effectively. Provide some training and ensure managers have up-to-date information on overtime law. From there, customize your internal training to meet the unique needs of your business.

Start reducing construction overtime costs now

Now that you know exactly what the overtime pay rules are regarding construction overtime pay and how to reduce your overtime costs, it’s time to get going.

Start by calculating your current overtime costs per week or month. Then, look into hiring subcontractors or short-term workers to pick up jobs on-site and keep overtime hours down.

In the long term, look at reducing downtime and increasing productivity with GPS time-tracking apps like Hubstaff. You can use the information you gain from Hubstaff to cross-train your employees, create better and more efficient schedules, and eliminate the need for overtime entirely.

Over time, you’ll find that your need to pay 1.5x for overtime dramatically reduces and that your projects get completed on time and within budget.

This article is intended to convey general information only and not to provide legal advice or opinions. Information is current as of the date published; overtime changes may have been made since this article was created.

Most popular

How Many Meetings Are Too Many? 2026 Benchmarks by Role

How many meetings are too many? In 2026, the honest and boring answer is: it depends on your role. Our 2026 Global Trends and Benc...

When Evening Work Becomes a Red Flag: How to Fix Triple-Peak Overload with Smarter Core Hours (2026 Data)

Most people don’t remember the first time they worked in the evening, and even fewer people know when the last evening work sess...

How Much Deep Work Do Employees Really Get?

Employees are more distracted than you think — and it isn’t due to lack of discipline. In fact, the blame falls far from them:...

What AI Time Tracking Data Reveals About Productivity in Global Teams (2026)

Global teams face one problem, and it isn’t total hours worked. Measuring time spent in meaningful, focused work can be a challe...