Your construction overhead and profit margins are two of the most important figures for your business. Yet many construction companies aren’t calculating them correctly, leading to tight budgets, slow business growth, and, in some cases, negative bank balances.

If you’ve been in the business a while, you’ll probably have heard of the 10-10 rule; it’s an industry standard for calculating overhead and profit (O & P).

However, overhead and profits vary widely across company sizes, project types, and businesses. For example, developers, remodelers, and custom builders all have different cost structures.

On average, construction work can attract a margin of 17-19%, remodeling work 34-42%, and specialty work 26-34%. However, if these figures don’t cover your direct costs or they price you out of the competition, they’re of no use.

That’s why it’s crucial to accurately calculate your construction overhead costs and profit. Then, you can use these figures to add the right markup and actually make money while staying competitive.

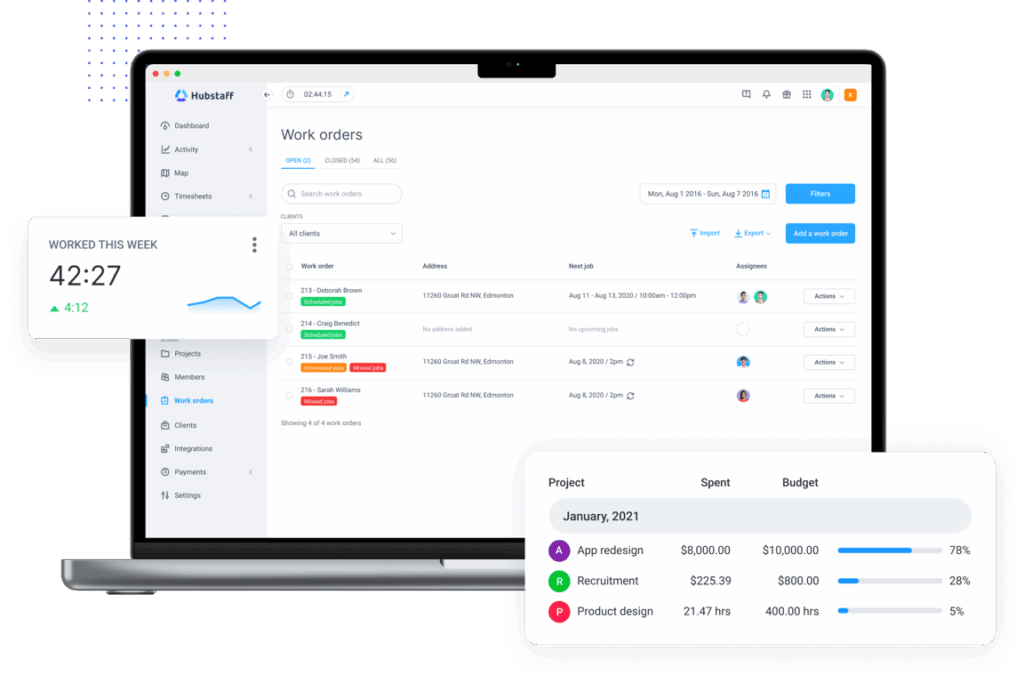

Boost your team’s efficiency with Hubstaff's productivity tools

What is overhead in construction?

Simply put, overhead refers to the costs associated with running a business. Examples include basics like rent, utilities, and payroll. In the construction industry, specific overhead costs might include:

- Executive and administrative payroll

- Employee taxes and benefits

- Insurance

- Professional fees, such as marketing and accounting

- Occupancy and utility bills

- Telephone and technology

- Vehicle expenses

- Tools and equipment

- Legal and marketing

- Other office expenses

These are just a few examples of overhead costs. But, as you can see, there’s a lot to think about when it comes to tracking overhead costs — and they have a huge impact on potential profit.

What is profit in construction?

Profit basically boils down to the amount of money left over after subtracting all overhead costs. It’s important to find this difference on a project-by-project basis. From there, you can calculate quarterly and annual profits for better forecasting.

For example, if you have a $100,000 contract, we all know you wouldn’t pocket the full $100K. Let’s say you have $70,000 in labor and $5,000 in materials to spend to complete the project. You’d walk away with $25,000 in profit.

Over the course of a quarter, a year, or the lifetime of your business, you can calculate profit margins by subtracting overhead costs and other expenses from your raw earnings.

The importance of correctly calculating your overhead and profit

Although adopting the industry standard for overhead and profit calculations is undoubtedly easier, there are three reasons why calculating these numbers yourself is essential to the health of your construction business.

1. Business management

Knowing your actual O&P enables you to run your construction business with confidence. You know how to price jobs, how much work you need to win, and what core requirements your business needs to function.

2. Business growth

Realistic O & P figures help you see where you can allocate money to different resources, such as marketing, hiring, or adding new tools.

3. Business protection

Finally, a proper analysis of your overhead and profits allows you to keep your bank balance in the green. You’ll be able to spot where you’re spending too much money and prevent yourself from under-quoting jobs.

How to calculate your overhead and profits

There are many different ways to calculate your overhead and profit, but we’re going to look at the most common methods.

Determine your construction overhead and markup

To calculate your construction overhead, add up your monthly fixed business costs. Some find it easier to add up their annual costs and then divide them by 12 to get their monthly expenses. The resulting figure is the amount of money you must make each month to keep your business alive.

Note that your overhead does not include any direct project costs, such as materials, field team payroll, or other labor. That’s because you’ll only have those costs if you have work to do.

Once you’ve calculated your monthly overhead, you can determine your markup. This is a percentage to add onto project estimates to cover overhead and keep your projects profitable. There are two different methods of doing this: by labor cost and by sales.

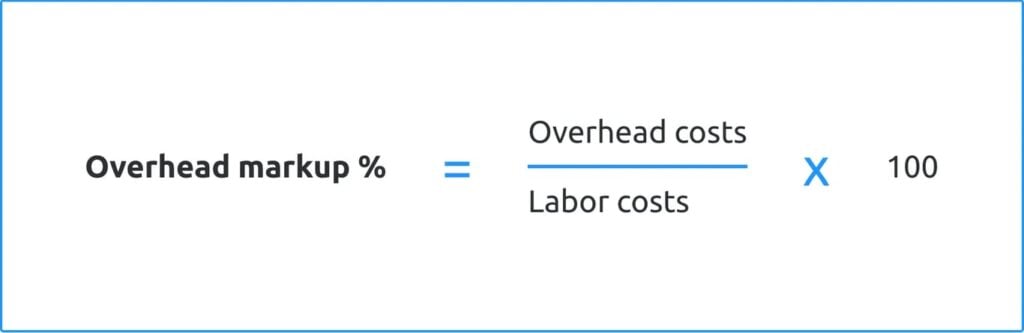

1. By labor cost

To calculate your construction overhead by labor cost, divide your monthly overhead by your monthly labor costs. This figure tells you how much of each dollar goes toward overhead.

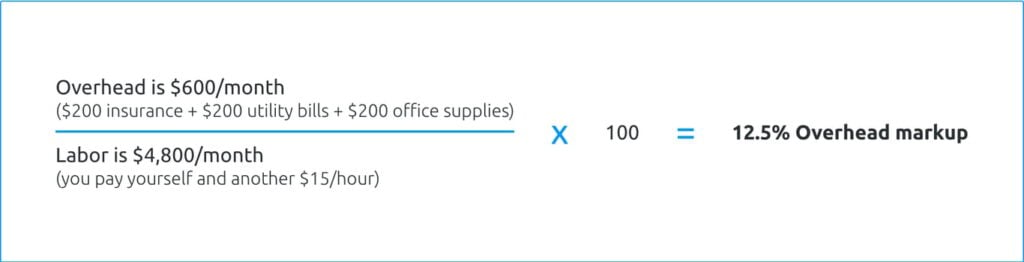

Example A:

Let’s use some real numbers as an example. Imagine you have monthly overhead costs of $600 ($200 insurance + $200 utility bills + $200 office supplies), and you’re the only employee. Let’s say you pay yourself $15/hour and work 40 hours/week ($2400/month).

What does this mean? For every dollar you make, $.25 goes straight to overhead.

If you have multiple employees, your overhead percentage will decrease because you’ll be able to spread your overhead across more projects as you take on more work.

Since you have more crew members doing more work, you can afford to spread out your overhead costs across more projects.

Note: This equation shows only what you need to charge on top of projects to cover your overhead costs. It doesn’t include any profit margins you want to incorporate.

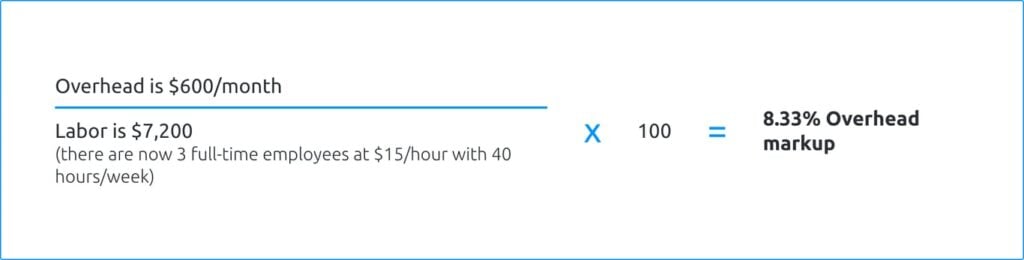

Example B:

Let’s say your overhead costs are $600/month, and you have two full-time employees: yourself and someone else.

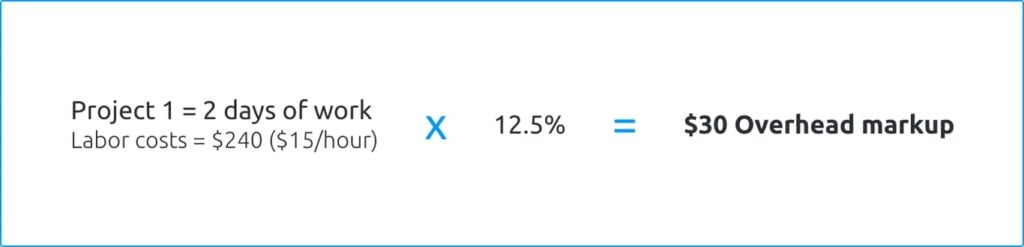

With that calculation, you know you should be adding at least 12.5% to your labor costs to cover overhead.

Now, say you get two renovation projects that’ll take around two days each.

Using your calculation above, your total overhead markup will be $60 so that you at least break even on costs.

If you take yourself away from the manual work to help with the business side of things, your own labor cost becomes overhead, which increases your overhead markup. Let’s go to example C to demonstrate this.

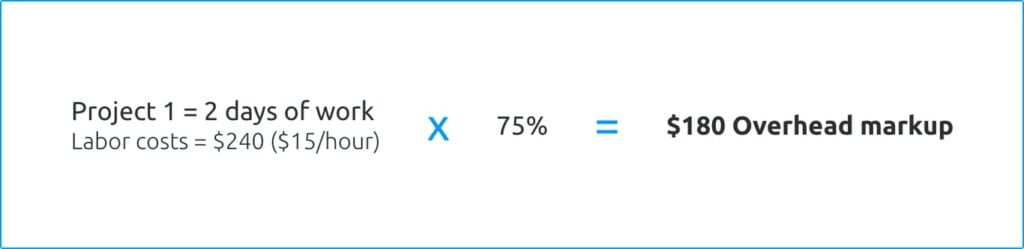

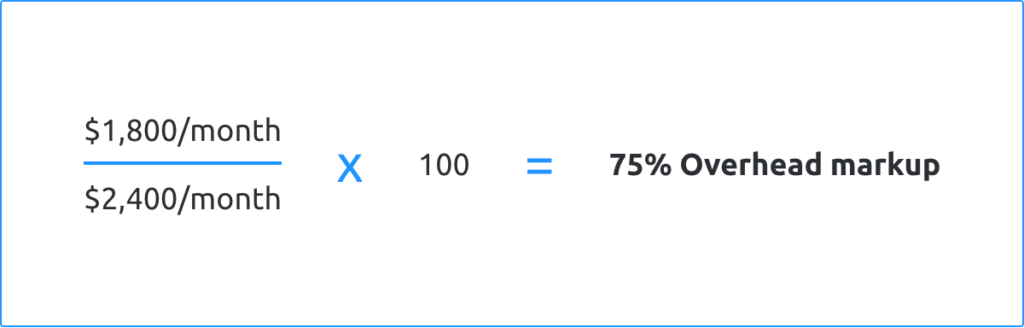

Example C:

Let’s say you want to shift from billable construction work to office work instead. Your time then shifts into an overhead cost because it isn’t going into a project with a dollar amount on it.

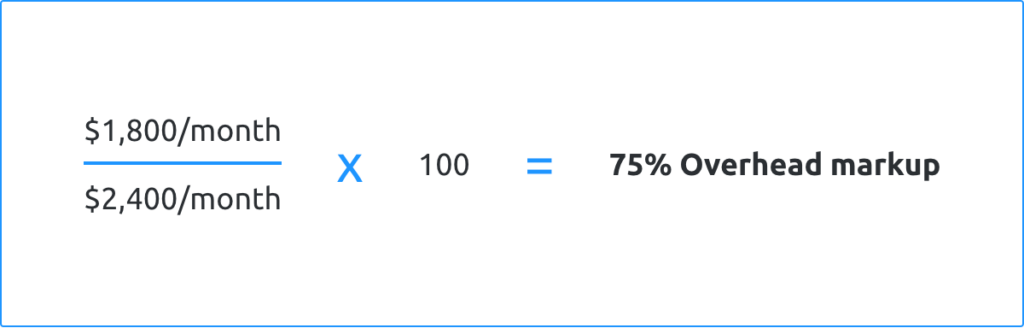

Your overhead costs include:$200 insurance+ $200 utility bills+ $200 office supplies+ $1,200 (your own cost of $15/hour x 20/week)= $1,800/month

Your labor costs are $2,400/month because you pay someone $15/hour for 40 hours/week.

You’d need to hire additional labor to reduce this markup or dedicate your spare 20 hours per week back on-site.

2. By sales

Let’s say you have a full-time team that is paid the same amount every month, but they do different amounts of billable work each month. In this case, you may want to calculate your construction overhead by sales.

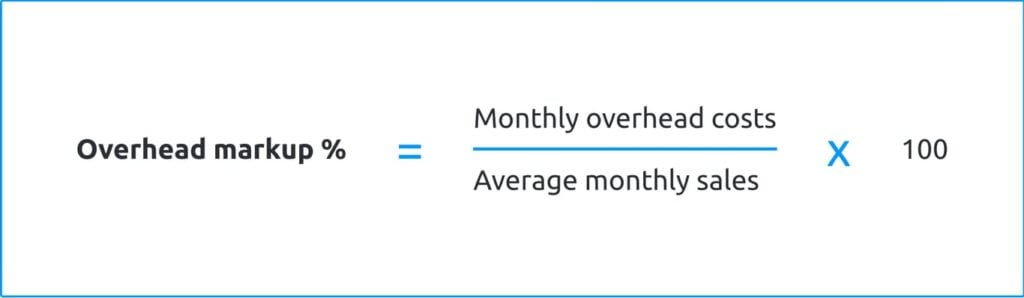

To calculate your overhead by total sales, divide your monthly overhead by your average monthly sales. This figure is your overhead markup percentage, which you add to a project estimate based on the cost of that project.

Example A:

In this example, let’s say your overhead costs are $600/month ($200 insurance + $200 utility bills + $200 office supplies). Your sales are $5,000/month. Here’s how you’d calculate your overhead markup:

That means if Project 1 will cost you $1,000, you need to add an overhead markup of $120 ($1,000 x 12%).

If you have multiple employees, your average monthly sales will increase, and your overhead markup will decrease because you’ll be able to spread your overhead costs across more projects.

Example B:

Let’s say your monthly costs are the same, but your average sales are $10,000/month.

For the same Project 1 with costs of $1,000, you’d need to add $60 ($1000 x 6%).

It’s also essential to remember that your overhead cost isn’t a one-time calculation. Business expenses can increase as well as decrease, so it’s crucial to re-calculate at least twice a year.

Calculating your construction profit

Your profit is the amount of money left over after paying for a project’s costs and overhead. This money can be used to reward yourself or your staff, to reinvest in business growth, or to provide a safety cushion for future losses.

Creating an appropriate profit margin for your business involves a little bit of trial and error with your profit markup.

Note: a profit markup (also known as a profit percentage) is different from a profit margin. A profit markup is a percentage you add to your project costs to generate a profit margin.

One way to find your target amount is to start adding a reasonable profit figure to your project estimates that reflect your overhead, for example, $50/day. If you’re failing to win projects based on cost, reduce this number until you become successful; if you’re winning projects, slowly increase this figure until you get some pushback on cost.

Once you’ve found and tested the “sweet spot,” you can calculate your profit markup (i.e., the percentage you add to your project costs to create this profit).

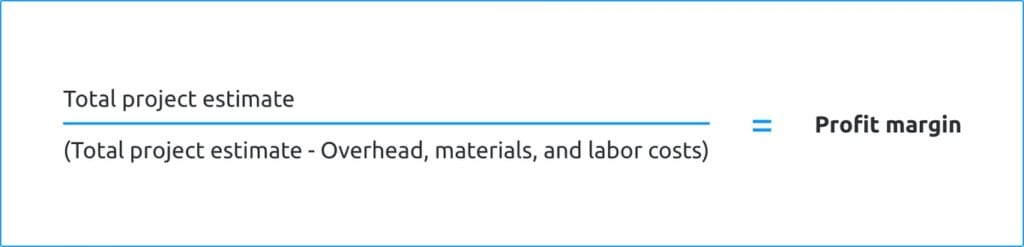

To calculate your profit percentage for a project, divide your profit figure by the total sum of overhead, material, and labor costs and multiply this by 100. This is the percentage of profit you have applied to the project cost.

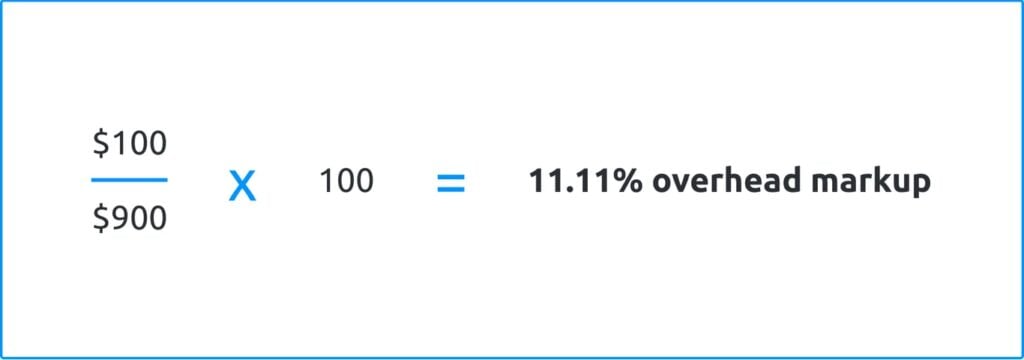

Example A:

Let’s assume your costs for Project 1 are $900 ($600 labor, $240 materials, and $60 overhead), with a profit of $100.

You can add this percentage to future project estimates to incorporate profit.

To calculate your profit margin for a project, divide your total project estimate by the total project estimate minus the overhead, material, and labor costs. This is the percentage that the profit represents of the overall project estimate.

Example B:

Your Project B estimate is $1,000, with $900 in costs ($600 labor, $240 materials, and $60 overhead).

Common Mistakes in Overhead and Profit Calculation and How to Avoid Them

Even with the right formulas and a talented team at your disposal, mistakes can and will happen when calculating overhead and profit. Here are a few examples:

- Profit margin vs. markup. A profit markup (also known as a profit percentage) is different from a profit margin. A profit markup is a percentage you add to your project costs to generate a profit margin.

- Fixed and variable costs. Don’t get lazy. Not all costs are fixed, and even slight fluctuations in equipment costs, taxes, inflation-adjusted raises, and other indirect costs can all come back to haunt you.

- Inconsistent profit tracking. It can be easy to fall out of the habit of tracking profits on every project, but it’s a slippery slope to estimating. This estimation can then hurt you in the long run.

- Overly complicated payments. There’s often a direct correlation between logistics surrounding payments and their costs. Streamlining payroll, invoicing, and expenses can help.

If you’re struggling to keep track of payments, there are tools that can help.

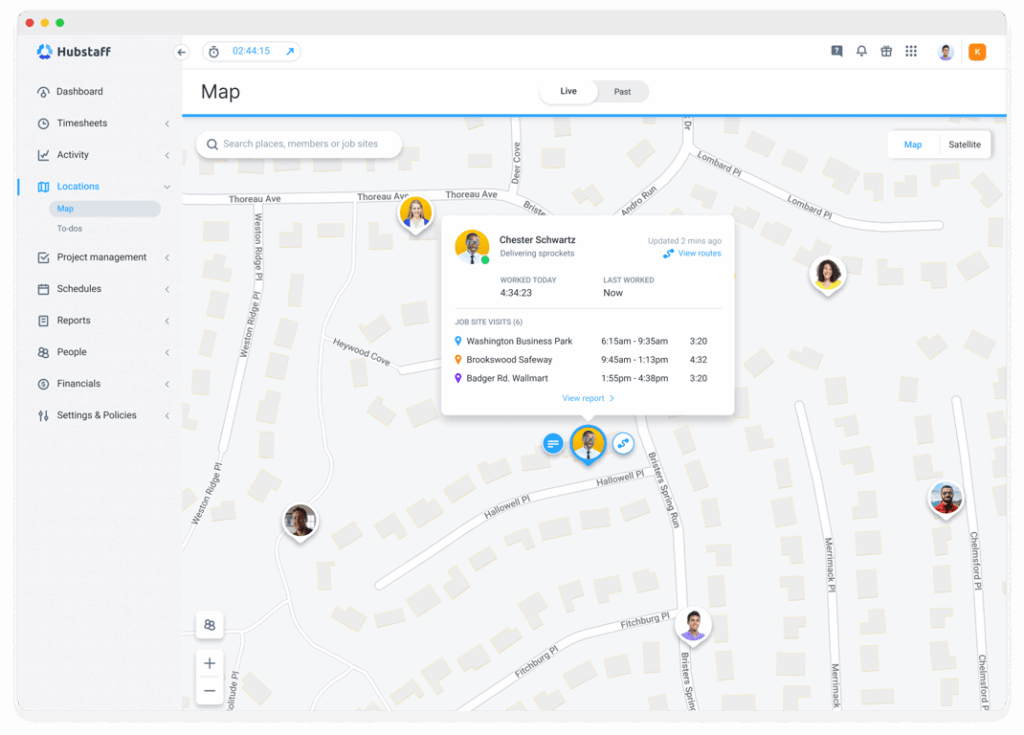

Tip for success: Utilize geofencing and time tracking to clarify expenses

Figuring out how much time your team spends on certain projects can be difficult to estimate, not to mention non-billable. However, it’s important to ensure your labor costs are accurate so that your overhead and profit calculations are, too.

Construction time tracking software with geofencing capabilities allows you to measure labor and improve the efficiency of your on-site teams. With auto-start and stop based on location, project time tracking is accurate and streamlined.

There’s no need to remind your team to punch in or to have to verify hours after they’ve been submitted.

Hubstaff uses the GPS on your crew members’ mobile phones to know when they’ve arrived at a job site and start the timer. At the end of the day, you’ll get a daily recap of what your crew did emailed to you. You’ll never have to chase down hours or question the time spent at a job site.

Better invoices and estimates

Finally, when you have a clear picture of exactly how long your team spent at a site, it’s easier to invoice clients and estimate future projects.

You can dig into over 17 different reports that help you understand how work gets done and where you can improve processes.

Now that you understand how to calculate construction overhead and profit, you can really start reducing overhead, increasing profits, and growing your business.

Most popular

Hidden AI Usage in the Workplace: What Your Tools Don’t Tell You

How much has AI changed your team’s work? On the surface, work might not look that different. The meetings are still there, docu...

How Many Meetings Are Too Many? 2026 Benchmarks by Role

How many meetings are too many? In 2026, the honest and boring answer is: it depends on your role. Our 2026 Global Trends and Benc...

When Evening Work Becomes a Red Flag: How to Fix Triple-Peak Overload with Smarter Core Hours (2026 Data)

Most people don’t remember the first time they worked in the evening, and even fewer people know when the last evening work sess...

How Much Deep Work Do Employees Really Get?

Employees are more distracted than you think — and it isn’t due to lack of discipline. In fact, the blame falls far from them:...