Tracking business expenses is a crucial part of financial management.

Small business owners and self-employed freelancers often struggle with the accounting aspects of running a company. However, to boost profitability and keep costs low, make sure numbers take top priority.

One way to do this is to ensure your spending habits align with budgets. Expenses also inform future forecasting and project estimating, making expense tracking important for every department within an organization.

Keep reading to gain insight on accurately tracking your business expenses. You’ll learn some proven strategies to support your financial business goals.

Boost your team’s efficiency with Hubstaff's productivity tools

Tracking different types of business expenses

Expense tracking is the process of monitoring spending activity. Whether for personal or business reasons, expense tracking is best done in real-time.

Record expenses by logging receipts, incoming invoices, and other business-related costs. Make sure you track all expenses from debit card and credit card usage, ACH bank account transactions, and cash purchases.

Companies use various forms of accounting ledgers to maintain their records. Whether you use accounting software, spreadsheets, mobile expense tracking apps, or a paper-based system, expense tracking is vital for every phase of a business, from development to expansion.

When used in conjunction with budgets and income records, this activity allows business leaders to get a bird’s eye view of the overall financial health of an organization.

The Small Business Administration explains that expense tracking is necessary for maintaining a “sustainable balance between profit and loss.” This activity enables companies to identify areas where curbing spending will provide growth opportunities.

Furthermore, accurate records are essential for preparing financial statements — balance sheets, cash flow statements, profit and loss statements — used to apply for loans and inform internal and external stakeholders.

When your bookkeeping department consistently follows best expense management practices, IRS reporting and tax filing processes are more accessible and efficient, relieving stress and reducing costs for your company.

Depending on the business and industry you own or manage, you will likely track recurring and non-recurring spending.

Recurring expenses are typically the same each month: loan payments, equipment rental, insurance, legal fees, and minimum supply replenishment for product manufacturing.

Non-recurring business expenses vary from month to month. Some examples include office supplies, repair and maintenance, severance pay, certain capital investments, and one-time purchases, such as new computer systems and cash purchases for equipment.

Subscribe to the Hubstaff blog for more posts like this

Best strategies for expense tracking

Every business has unique expenses. Your costs might be calculated based on buying premade items and reselling them or a process that involves research and development that leads to in-house production.

If your work is custom, your budget will need to be similarly proprietary, too. Your budget should guide spending behavior and prevent overspending.

Although your actual expenses may differ from other companies, you should consider a few common crucial steps when starting expense tracking.

1. Categorize your expenses

Breaking down dozens of expenses into specific categories when using a manual system can be tedious. However, keeping track of your business records can help you save money.

For one thing, you’ll find it easier to get all the IRS deductions you’re eligible to take. According to Mazuma, missed employee expense deductions as one of the top five tax deductions small businesses leave on the table when filing their annual returns.

And as mentioned above, a breakdown created based on your specific financial goals and expenses provides opportunities to renegotiate vendor contracts for everything from monthly landscaping and cleaning services to office supplies and insurance coverage.

2. Update tracking regularly

The Pittsburgh Financial Endowment Foundation reminds clients that expense tracking is not a “set it and forget it” type of process. They advise tracking every expense, along with all incoming bills, daily.

Following their advice is a fantastic strategy. The formula should include updating your tracking policies as your company contracts or expands.

Updates might include:

- Adding new vendors

- Editing spending limits

- Ensuring all employees with buying authority have proper credentials

- Creating or deleting categories to reflect the current business model

3. Save digital and paper receipts

Even if you use mobile apps and a fully integrated accounting system that includes expense management features, always keep paper receipts.

The IRS does encourage digital receipts, and having copies of this data is prudent. Digital records, cloud storage, and automatic backups can protect your data.

But even cloud data loss can occur for a variety of reasons. Malicious activity, user error or accidental deletion, and over-writing data are the three most common reasons cloud data is lost.

A non-virtual, physical backup can be a good idea. Check with your state and local taxing authorities, CPA, or bookkeeper to see how long you should retain paper receipts.

4. Keep a monthly expense report

A monthly expense report allows you to track spending separated by expense categories.

You can use an Excel spreadsheet, a paper ledger, or a budgeting app. The important thing is to keep track of your expenses, so you know where your money is going.

There are a variety of worksheets and expense report templates available online today.

For example, an employee expense report may have columns to categorize transportation, meals, phone, lodging, fuel, and entertainment spending.

Some employee expense reports have space to log time spent with specific clients or on certain projects, enabling accurate comparison to the monthly budget figures and billing.

Unlike spending categories in an employee expense report, a small business monthly expense report typically includes columns for rent/mortgage, utilities, property taxes, insurance, licensing and fees, professional services, marketing, and other operational expenses.

Keeping monthly expense reports helps business leaders achieve their financial goals based on real-time data. And as part of an overarching expense management strategy, monthly expense reports inform training processes, purchasing policies, and certain financial decisions, such as establishing savings goals.

Tip: Motivate your employees to keep their paper receipts and submit them to the bookkeeping team, or log their expenses using their monthly expense tracking tools.

One of the best ways to encourage tracking and reporting is to remind your employees that managing business finance simplifies managing personal finance.

When creating a personal budget, they will have all the information they need to track the cost of work-related items and how much they can expect to receive in reimbursement.

For instance, if your company pays mileage instead of reimbursing actual fuel costs, the employee can quickly calculate the difference and add or subtract that amount from their personal budget.

Closing thoughts

Expense tracking is a valuable tool for monitoring company spending. You can track your expenses for each employee, each department, or the company overall.

You need a working budget to maximize the benefits of expense trackers and calculators. It is important to note that budgets and expense tracking programs have a circular relationship. Budgets inform spending policy, and tracking spending informs budgeting and forecasting.

Managing business finances is not always easy. However, the benefits far outweigh the effort spent. Whether your company is overspending on supply replenishment or is looking for ways to reduce the tax burden, tracking expenses by category offers a path to fix those problems.

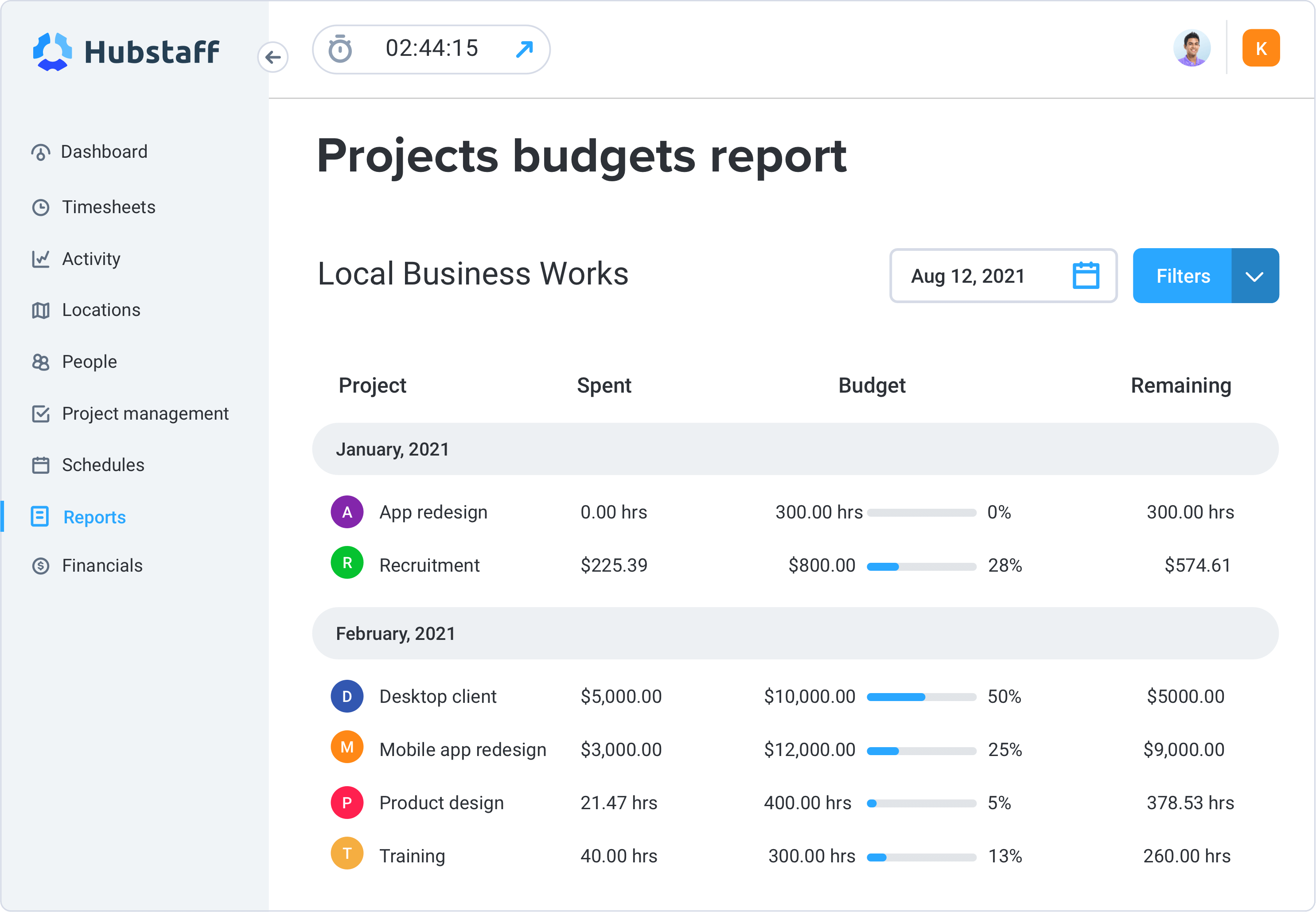

Hubstaff offers a feature-packed software solution to simplify tracking company expenses. Use our software to store digital receipts and connect tracked time to specific clients or projects.

Our workforce management tools allow managers to take control of their budgeting, payroll, and invoicing processes for improved money management throughout an organization.

Are you struggling to meet your company savings goals? Does your P&L reflect a lower profit margin than you would like? Contact our team for a software demo today.

Most popular

The Fundamentals of Employee Goal Setting

Employee goal setting is crucial for reaching broader business goals, but a lot of us struggle to know where to start. American...

Data-Driven Productivity with Hubstaff Insights: Webinar Recap

In our recent webinar, the product team provided a deep overview of the Hubstaff Insights add-on, a powerful productivity measurem...

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...