One of the best ways to track your team’s hours (we think) is with Hubstaff. Our robust time tracking app makes it easy to track time, activity, and progress on projects all in one place.

Hubstaff can also be used to calculate billable hours. Here’s how:

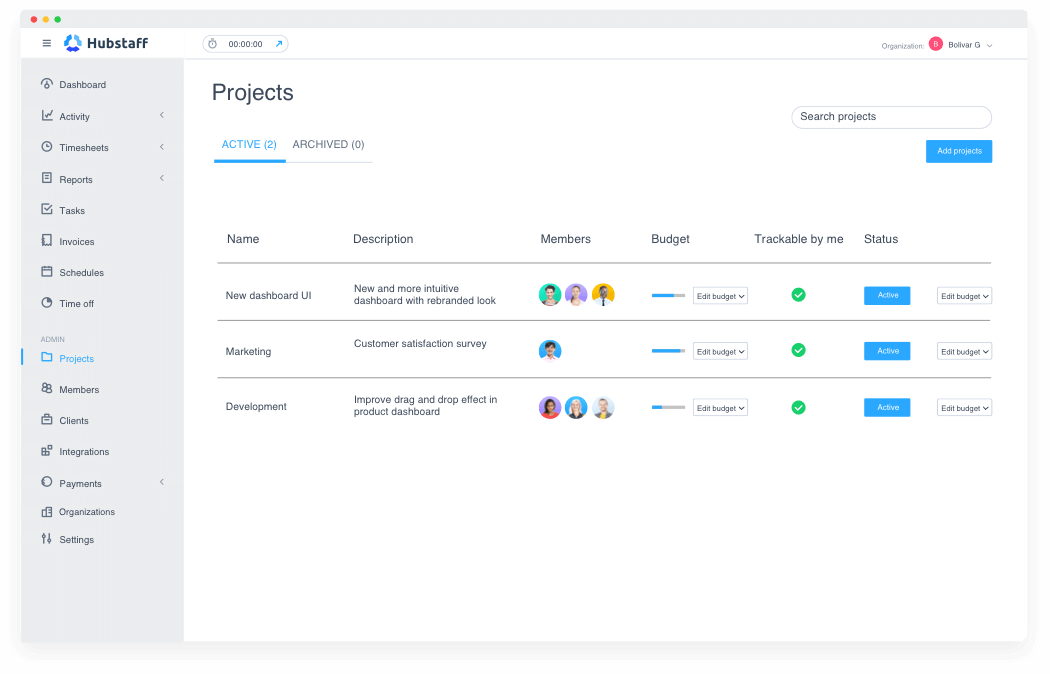

Step 1: Set up projects or clients to bill towards

Inside Hubstaff, you can set up individual projects based on your unique clients. If you’ve been using Hubstaff, you’ve probably already done this. But, if you’re new to our platform, you can easily do that in your projects tab.

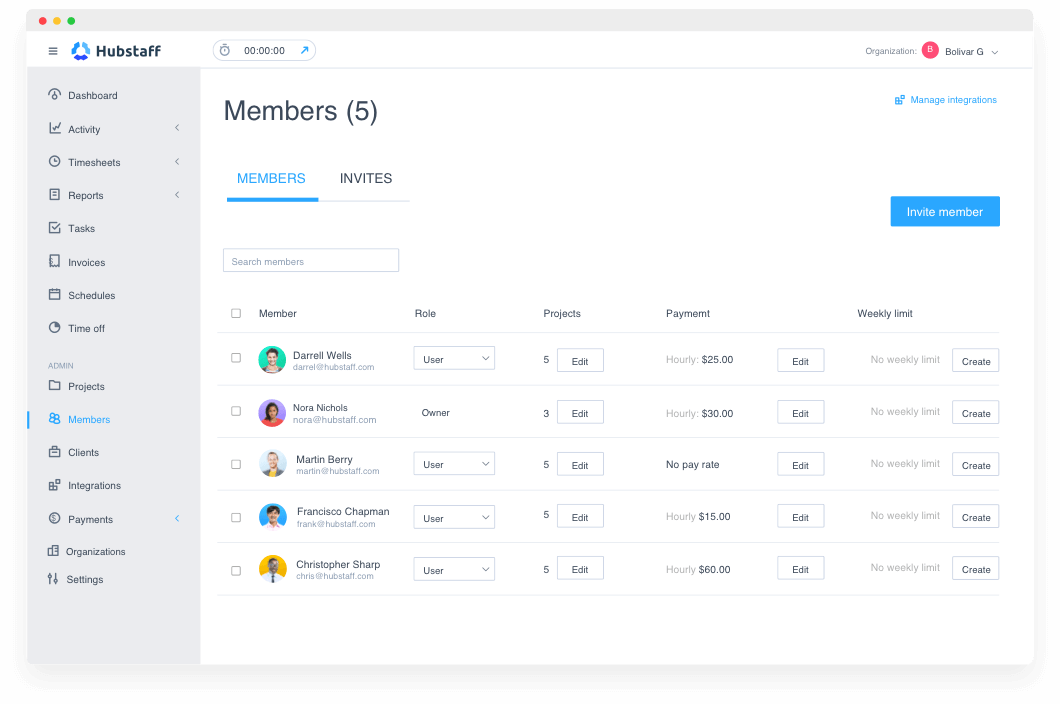

Step 2: Set your billable rates

Hubstaff makes it easy to set billable rates for each team member. By doing this, you can fully customize what each team member accrues based on the projects or clients that they’re working on.

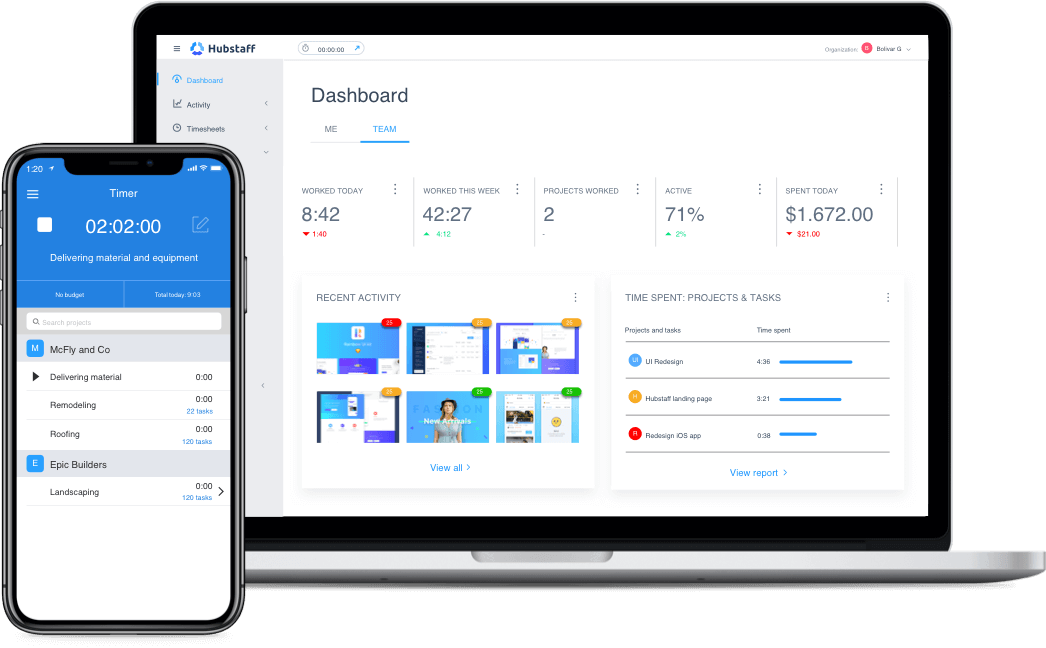

Step 3: Track your team’s time

Once you’ve set up your projects and rates, the next thing to do is get down to business. Have your employees track their time using our desktop, web, or mobile apps. Depending on the project they’re currently working on, ensure your team is tracking their time towards the correct task.

Step 4: Set a few budget limits

While your team is cracking away at their tasks, ensure they’re not going overboard by setting budget limits. You can do this in the projects tab in Hubstaff. By selecting a project’s budget limit, you can make sure that the appropriate amount of time is being spent on any given project based on what you’ve quoted your client or how much money you’ve allocated toward that task.

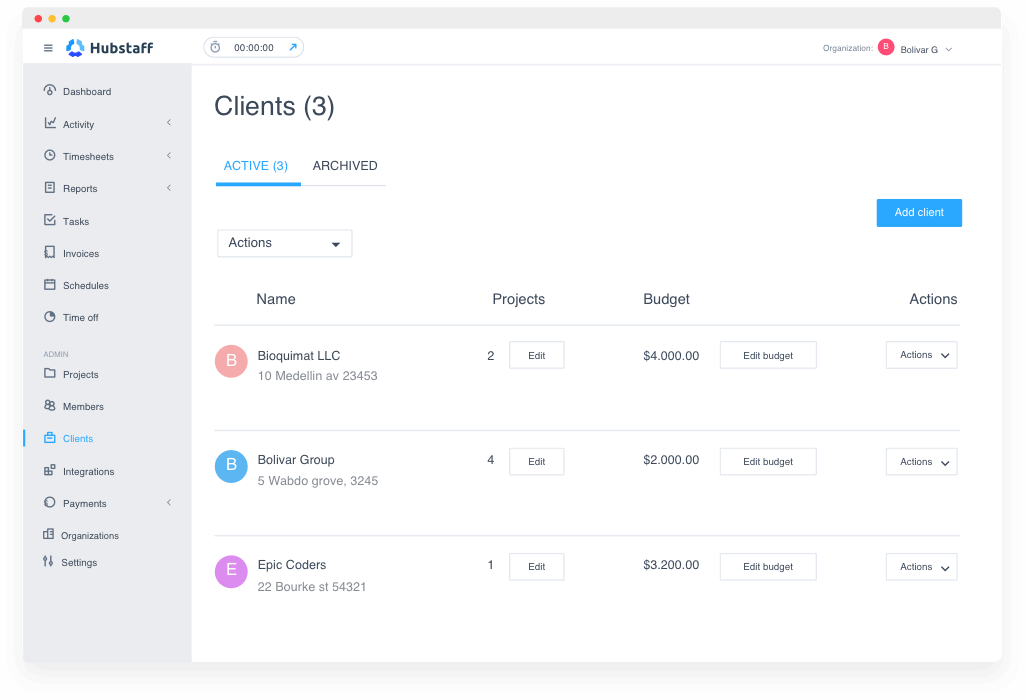

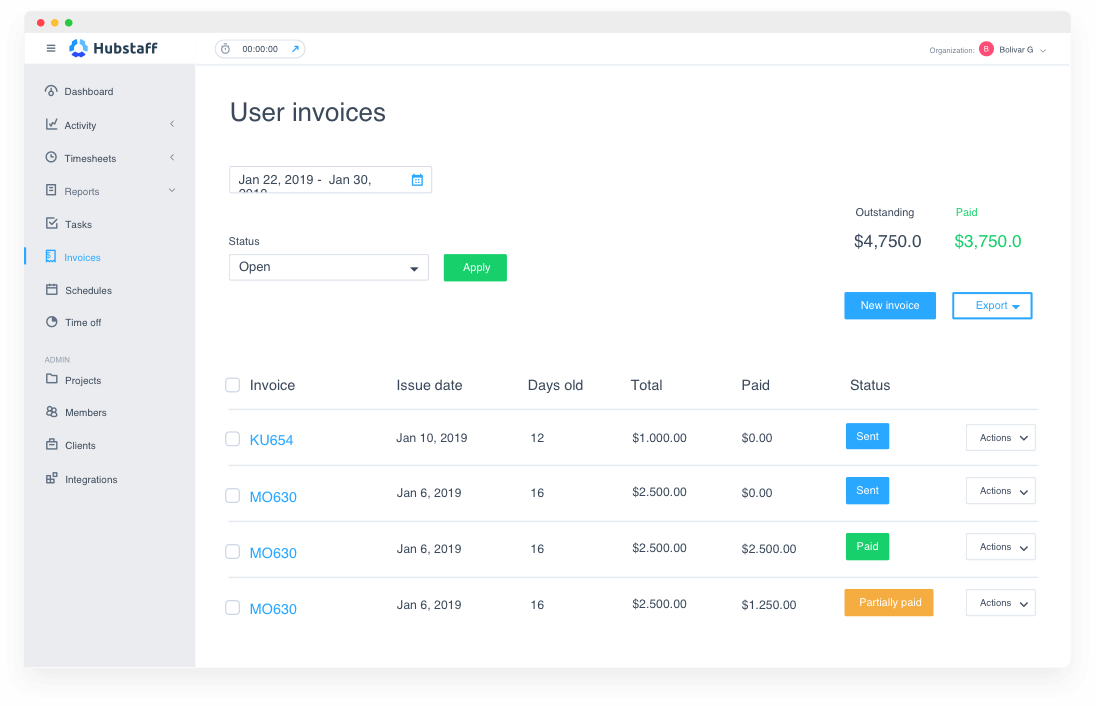

Step 5: Invoice your clients and pay your team for hours worked

After the workweek ends, you’ll get a notification in your inbox that it’s time to pay your team members for all their hard work. All you have to do is accept their hours worked, and they’ll automatically be paid based on the bill rate you set up before.

Once it’s time to send the client the bill, you must head over to your invoices tab within Hubstaff. Find the client to whom you’d like to send the invoice, and Hubstaff will automatically calculate the line items based on the work your team has done for them. Then, you have to send them the invoice; it's as simple as that.