Billable hours are the hours spent working on client projects. Non-billable hours are any that are spent on administrative or overhead projects that are not directly related to client service.

For example, sending emails to clients would count as billable time. However, upgrading your email software wouldn’t count as directly servicing those accounts.

Calculating billable hours can help determine employee workloads and manage efficiency. If this process is new to you, here’s what you should know about billable vs. non-billable time.

Billable hours

The advantage of billing time to clients with set billing rates is that it gives your client a clear picture of how you spent your time and why it is worth their money. Tracking hours you’re billing also ensures you will be paid for any overtime hours worked.

Your client may ask that you to note what you’re billing for them. This provides further clarity for them, and while it can be more work for you, it is a way to demonstrate your process and progress to the client.

Here are some scenarios when you will need to use billable hours:

Sending invoices to a client

Preparing project estimates

Payroll for employees and freelancers

Budgeting future projects

Depending on your client agreements and internal policies, billable time may or may not need to be reported on a timesheet. Regardless, timesheets allow for simple billable hours tracking and ensure the accuracy of your billable hours estimate.

Non-billable hours

Non-billable hours are not a complete loss for your business. While clients may not pay for this time, it is still necessary.

Depending on your internal policies and agreements, getting up to refresh your coffee or chatting with your team during a Sprint meeting will not be billed to a client.

As an employee, don’t worry; your employer will still pay you for these hours. For freelancers or business owners, non-billable hours will help you increase your profits and benefit your business.

How many working hours should be billable?

Now that you know the difference between billable and non-billable hours, you’re probably wondering, how often should I be doing work that isn’t billable?

There isn’t a straightforward answer, but we all know no one can be working on client projects for 8 hours a day (you’ve got to get a lunch break in your day!).

But how productive should you be in terms of client work, especially when you’ve got to pay the bills? Your expected billing rate depends on the industry and your client’s expectations.

On average, that typically means billing around 30 hours out of 40 working hours a week. For some high-performing fields, that number may be even higher.

According to the Yale Law School Career Development Office, “to be profitable to your firm, [legal professionals] must make enough money from your billable hours not only to cover your salary and overhead but also to generate revenue for the firm.

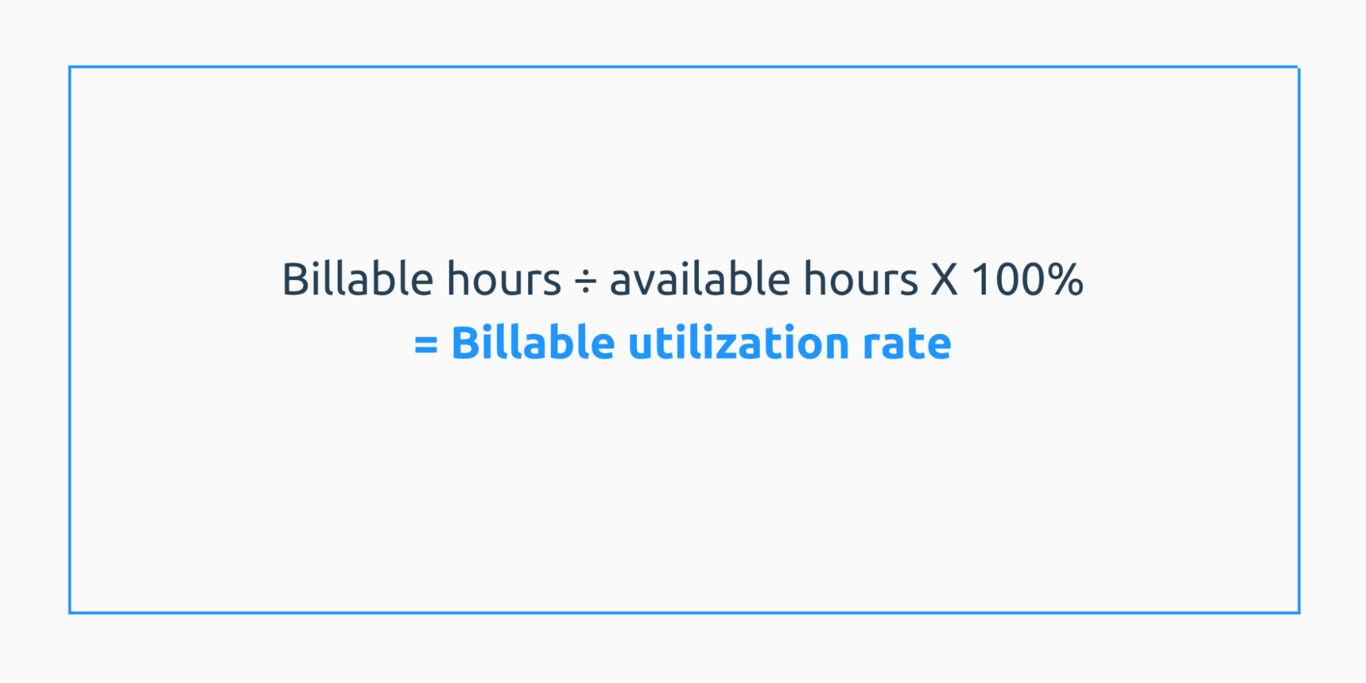

The most direct way to track your productivity using billable hours is to determine your utilization rate. You can evaluate your billable hours' utilization rate with this formula.

Depending on requirements, you may also need to consider the opposite — the issue of billable rate overrun. The overrun rate means you have exceeded the allotted hours a client has allowed for a project.

Depending on requirements, you may also need to consider the opposite — the issue of billable rate overrun. The overrun rate means you have exceeded the allotted hours a client has allowed for a project.

You will get used to balancing your billable hours over time. By automating your hourly time tracking, you may be able to increase your utilization rate and spend less time focusing on tracking your billable hours.