Most employees are familiar with the concept of overtime, where employees see a boost in their hourly rate when working beyond their normal weekly hours. Double-time pay is rarely required in the United States, though some companies will go as far as offering it as an incentive for working longer hours

Our goal is to help you understand what double-time pay is, where it’s mandated, how to realistically offer it as a perk, and how to calculate it. Let’s dive into this big payday.

Boost your team’s efficiency with Hubstaff's productivity tools

What is double-time pay?

Double-time pay is a compensation rate that pays you twice your regular pay rate when you exceed a certain hour cap set by state laws or your job description. You may also get double-time pay per hour for special events that your company defines. This includes federal holidays, overnight shifts, or days when your business is normally closed.

Double-time pay, sometimes called double overtime, is an incentive for people to work longer or pick up more difficult shifts. Companies often use this as a way to compensate for an excessive or unusual request for that person’s time and commitment.

Double-time pay is only mandated under California law and only applies after a person has already entered the overtime pay hours. Federal overtime provisions only cover non-exempt workers who have worked over 40 hours in a workweek. They specify that the rate needs to be “not less than time and one-half their regular rates of pay.”

In many instances, local laws also do not require double-time pay per hour at any point. We’ll explain where states like California mandate double-time pay below. For most people, double-time pay is only a benefit a company offers, not a guaranteed wage boost.

Double-time pay vs. overtime: Understanding the differences

Overtime is commonly understood as additional compensation for hours worked beyond the standard 40-hour workweek. When you begin to exceed hour 40, you’re typically entitled to pay at 1.5x your standard hourly rate.

Double-time pay is a higher scale at twice your normal hourly rate. However, the core difference between overtime and double-time pay is that overtime is federally required, with each state having specific overtime pay laws. Double-time pay is only mandated under California law, and it only applies after a person has already entered the overtime pay hours.

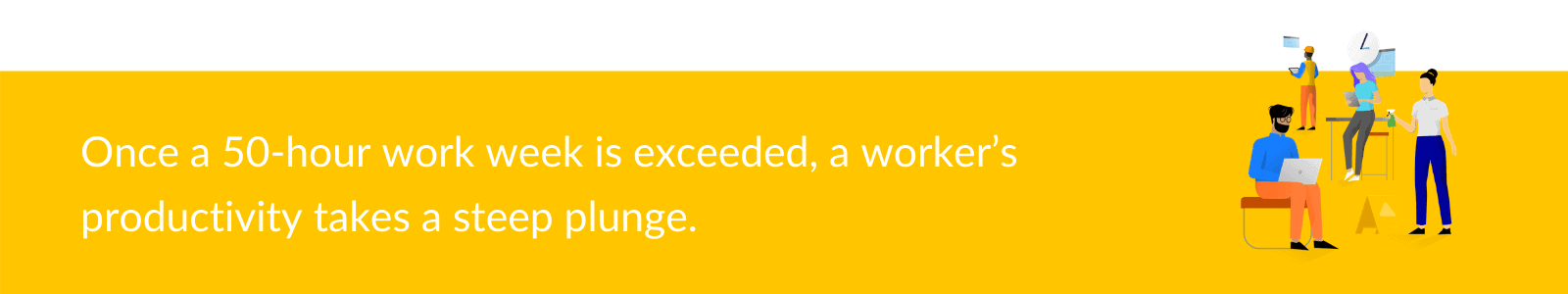

Overtime seems like a win-win, but you might want to work to reduce overtime and double-time. That’s because your team gets more stressed, and the quality of work can decline. It’s often better to give your team a break and save a little money in the process.

How to calculate double-time pay per hour

Calculating double-time pay involves more than just multiplying the hourly wage by two. It requires a nuanced approach that considers factors such as the employee’s base rate, overtime rate, and the specific circumstances triggering double-time pay.

Thankfully, you shouldn’t need a double-time pay calculator unless you have a large organization. What’s most important is tracking your company’s policies and how many hours people work in a given day and week.

The steps of any double-time pay calculator break down into:

- Recording the hourly rate of the employee.

- Determining the number of hours that qualify for double-time pay.

- Multiplying those hours by twice the employee’s hourly rate (Step 1).

- Then, adding this to their standard pay to create a total wage for the given period.

The challenging part may be in determining which work hours qualify for double-time pay. You’ll need to articulate these circumstances in your company’s policy handbook.

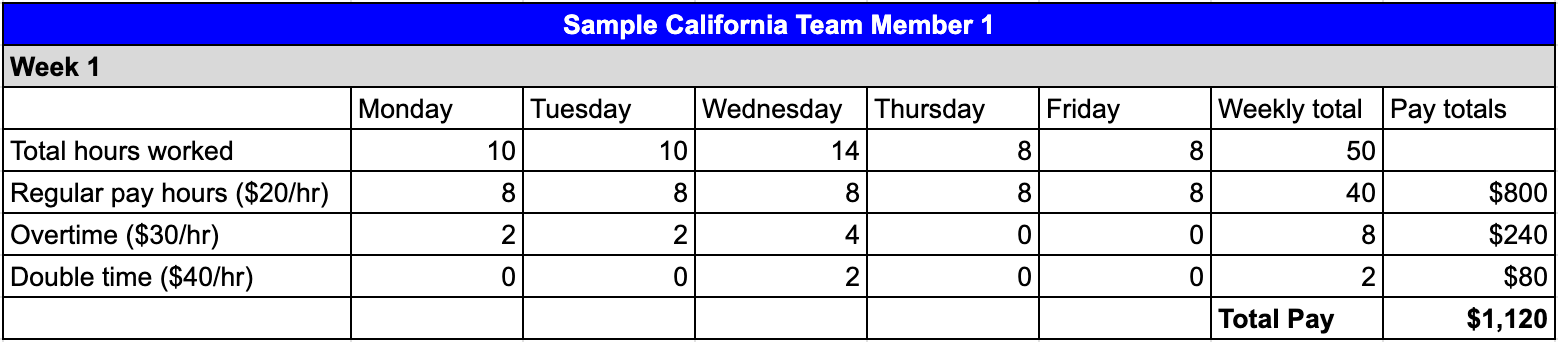

In the U.S., the only state currently with double-time pay laws is California, so we’ll use it as our example.

A brief California example

Let’s start our calculation for a hypothetical team member in California. It might seem obvious, but we want to make sure we’re focused on employees who earn an hourly wage. Salaried employees are not entitled to overtime or double-time pay.

The California labor code has us consider their regular hourly rate, overtime work, and the overtime threshold that causes them to move into a double-time pay rate.

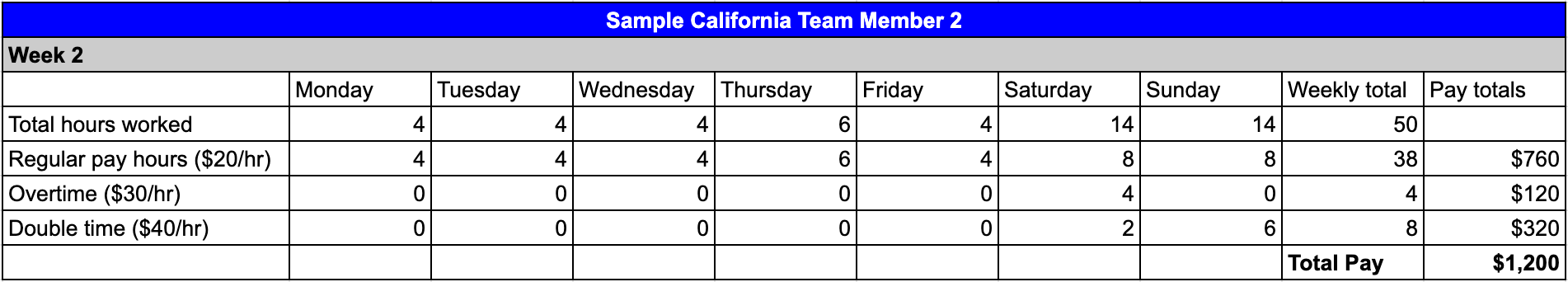

For our example, we’ll use the following details:

- Our employee’s regular pay rate is $20 per hour.

- California’s overtime pay rate starts when someone works more than eight hours in a workday.

- After eight hours, they make time and a half.

- After 12 hours worked in a single day, the employee makes twice their regular rate of pay.

- If someone works seven consecutive days, the double-time laws apply after the eighth hour on that seventh consecutive day.

The two charts below show how a pair of workers in California can both work 50 hours in a week at the same rate but have very different schedules and different pay at the end of that week. When you pay double-time wages over a biweekly or semi-monthly pay period, these differences become even more glaring.

Legal aspects of double-time wages

In short, there are very few times you’re expected to offer a double-time pay rate. Whether you choose to offer double-time pay as a benefit or because of the law, you want to know a couple of important legal implications.

The state and federal landscape

The legal landscape of double-time pay is straightforward. While states have a variety of labor laws, only California expands its overtime pay requirements, specifically including a double-time rate.

If you want to learn more about federal law, pay rates, pay period, regular hours, and more, your starting point is the Wages and the Fair Labor Standards Act page from the Department of Labor. The Fair Labor Standards Act, or FLSA, clearly lays out exemption statuses and federal regulations for overtime hours worked.

There are a variety of overtime exceptions that you should also review.

Specifics of double-time pay in California and Texas

California and Texas have their own set of rules regarding wages and hours worked. California is the only state where double-time pay applies by law. It starts for hours worked beyond 12 in a single workday or beyond the eighth on the seventh consecutive day of work.

Because of its economy, Texas is often searched alongside double-time rate options. However, there are no double pay rate laws or requirements in Texas. If you choose to offer it here, it is entirely a bonus structure you choose based on hours worked.

What to know about holiday pay and hours worked

Holidays often come with unique compensation considerations, but in the U.S., these are typically governed by company policy instead of a rule about overtime wages.

Rhode Island and Massachusetts have laws covering holiday pay and hours worked, but these states require a company to pay overtime rates, not double-time wages.

Understanding the rules surrounding double-time pay during these periods is crucial. Whether it’s a national holiday or a specific company-designated holiday, employees should be aware of their entitlements to fair compensation, including double-time pay.

Part-time workers and those without regular hours

Part-time team members typically get access to overtime pay only when they work more than 40 hours in a given week. Some general exceptions to overtime often apply to types of jobs that are part-time. See our guide on overtime for a list of state laws and exemptions.

However, in California (or if your company offers it beyond a normal pay rate), double-time pay kicks in for part-time workers once they exceed set hourly limits. That means it’s important for employers to consult local labor laws and create clear policies around overtime and double-time pay. Full-time and part-time employees must do their due diligence before signing on for additional hours.

Relevant information and best practices for employees

We’ve examined how employers can improve workforce management by implementing double-time pay rate calculations and administrative processes. However, there are some considerations for professional employees and paid overtime.

First, employees should look at federal and state laws that address how people are typically paid and their total pay. Federal and state laws provide clear guidance on overtime compensation, especially time and a half pay.

Knowledgeable employees play an active role in ensuring fair compensation practices within the workplace. These team members will also want to learn about their company’s double-time pay policy because these rates can vary based on job roles, contracts, union membership, and more. For example, some irregular or undesired shifts may always get a time-and-a-half or a double pay rate.

If the policy is unclear, employees should request help from their employer and keep records of this request and the response.

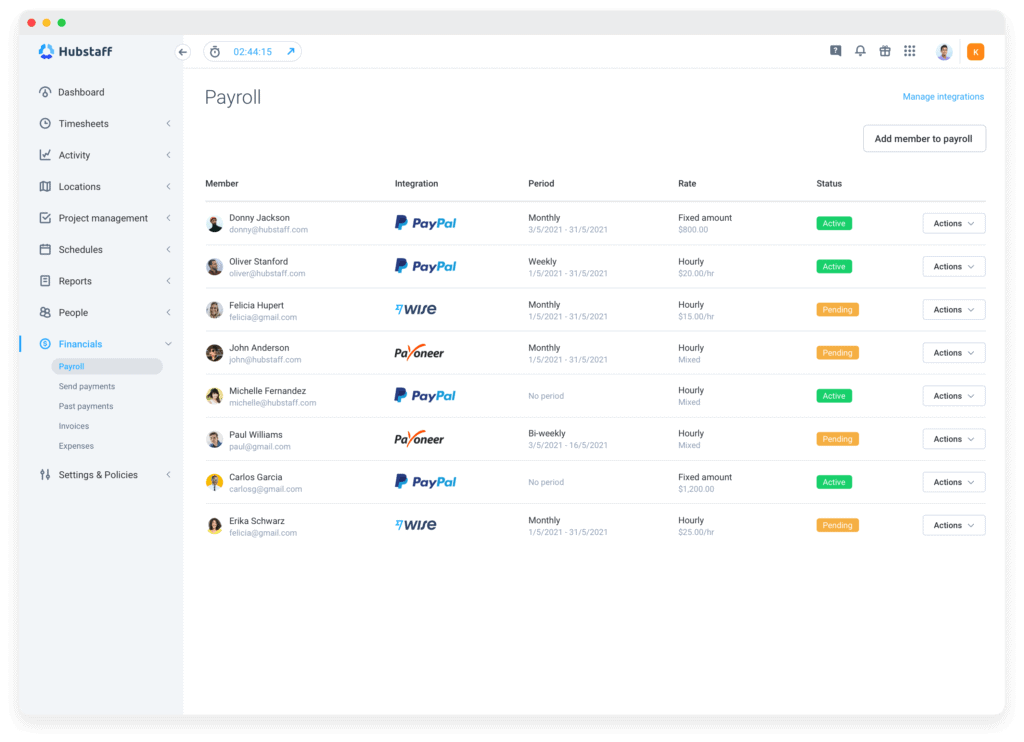

Detailed records are also a good idea when you’re eligible for double-time pay. Keep your pay stubs, timecards, and tracked hours in platforms like Hubstaff. These details ensure you can quickly and easily ask for appropriate pay based on your work hours.

Ensuring fair compensation through double-time pay

Navigating the complexities of double-time pay requires a comprehensive understanding of its definition, calculations, laws, and applications. By adhering to best practices, employers and employees can contribute to a fair and transparent compensation system, ultimately fostering a harmonious work environment and promoting mutual trust between employers and their workforce.

After you’ve got the policy in place, Hubstaff makes it easy to track hours properly and pay people their double-time pay rate. You can see a custom demo or grab a free trial here to get started and improve your payroll through smart automation today.

Most popular

The Fundamentals of Employee Goal Setting

Employee goal setting is crucial for reaching broader business goals, but a lot of us struggle to know where to start. American...

Data-Driven Productivity with Hubstaff Insights: Webinar Recap

In our recent webinar, the product team provided a deep overview of the Hubstaff Insights add-on, a powerful productivity measurem...

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...