Navigating the intricacies of payroll management is a crucial yet often challenging task for businesses. Payroll issues are daunting, from compliance hurdles to the complexities of benefit calculations.

Whether grappling with legal compliance, avoiding calculation errors, or staying up-to-date with tax regulations, our guide equips business owners and payroll professionals with actionable insights to streamline payroll processes and foster financial stability.

Join us as we unravel the critical challenges in payroll management and discover practical solutions to enhance accuracy, compliance, and overall payroll efficiency.

Boost your team’s efficiency with Hubstaff's productivity tools

10 most common payroll errors and how to avoid them

Understanding payroll errors is crucial for seamless management, from data entry mishaps to compliance challenges. Let’s explore each issue and uncover strategies to overcome them, ensuring your payroll processes are efficient, accurate, and compliant.

1. Data entry mistakes

Manual errors in entering crucial employee information, such as hours worked or tax withholdings, can have significant consequences. For instance, inaccuracies in recording work hours may result in underpayment or overpayment of wages, directly impacting employees’ financial well-being. Similarly, errors in your tax withholding can lead to compliance issues with tax authorities.

Here is what you can do to avoid this mistake:

- Automate, automate, automate: Transitioning from manual data entry to automated systems is a crucial strategy to minimize errors. Payroll software can automate various aspects of data input, reducing the reliance on manual processes.

- Audit your system regularly: Regular audits of payroll data are essential for promptly identifying and rectifying errors. Audits act as a proactive measure to catch discrepancies before they escalate.

- Employee training: Provide comprehensive training to the payroll team on accurate data entry practices. Establish clear guidelines and protocols for entering employee information, emphasizing the importance of precision and attention to detail.

2. Misclassifying employees

Incorrectly classifying employees as independent contractors or vice versa can result in legal and tax complications. Understanding the criteria for each classification and regularly reviewing worker status helps avoid misclassifications.

Here’s what you can do to avoid this mistake:

Businesses must comprehensively understand the criteria differentiating employees from independent contractors to avoid misclassifications. Factors include the employer’s control over the worker’s tasks, the degree of independence the worker exercises, and the nature of the working relationship.

Regularly reviewing these criteria and reassessing worker status is crucial, especially when there are changes in job responsibilities or working arrangements.

3. Late or incorrect tax filings

Missing tax filing deadlines or providing inaccurate information to tax authorities can result in penalties. Tax authorities enforce strict deadlines for submitting payroll-related documents, including W-2 forms and quarterly or annual tax filings.

Missing these deadlines often triggers financial penalties. The severity of these penalties may escalate with the duration of the delay, potentially leading to substantial monetary repercussions for the business.

Here’s what you can do to avoid this mistake:

Maintain a meticulous tax calendar and seek professional assistance to ensure timely and accurate filings.

4. Overtime calculation errors

Accurate calculation of overtime pay is a critical aspect of employee payroll management, and mistakes in this area can have significant repercussions for employees and employers. Whether due to a misunderstanding of overtime laws or inaccuracies in calculations, errors in overtime wages can lead to underpayment or overpayment, posing financial and legal challenges.

Here’s what you can do to avoid this mistake:

Regularly review and update overtime policies and leverage payroll software for accurate calculations. Check out our guide to understanding overtime wages and avoiding unnecessary overtime payouts.

5. Failure to deduct and remit garnishments

Neglecting to deduct and remit court-ordered wage garnishments can lead to legal consequences. Failing to comply with such court directives jeopardizes the financial stability of affected employees and exposes the employer to potential legal actions, fines, and penalties.

Here’s what you can do to avoid this mistake:

Businesses must establish robust processes to accurately and consistently adhere to court-ordered wage garnishments.

6. Benefit calculation errors

Inaccuracies in calculating employee benefits, such as health insurance or retirement contributions, can impact overall compensation. This affects individual employees’ financial well-being and can lead to dissatisfaction and potential talent retention challenges.

Here’s what you can do to avoid this mistake:

Businesses should prioritize precise benefit calculations, implement regular audits, and communicate transparently with employees to build trust and ensure that the full value of their compensation package is realized.

7. Missing deadlines

Failure to meet deadlines for payroll processing, tax filings, or other regulatory requirements can result in penalties. Establish a well-defined schedule, automate where possible, and conduct regular reviews to ensure your team meets deadlines.

Here’s what you can do to avoid this mistake:

Get a task tracker tool that works for your team. Learn more about how a task tracker works.

8. Ignoring state and local tax regulations

Overlooking regional tax regulations not only impacts the business’s financial health but also tarnishes its reputation. Customers, employees, and stakeholders may view non-compliance unfavorably, eroding trust and confidence in the organization’s ethical and legal practices.

Here’s what you can do to avoid this mistake:

Stay informed about regional tax requirements, and ensure your payroll system is configured to account for these specific regulations.

9. Inadequate record keeping

Poor record-keeping practices make it challenging to address discrepancies or face audits. Maintain organized records, implement digital storage solutions, and conduct regular internal audits to ensure accuracy and compliance.

Here’s what you can do to avoid this mistake:

- Maintain organized records: To address these challenges, businesses must prioritize maintaining organized and detailed records. This involves documenting all aspects of payroll processing, from individual employee information and hours worked to tax withholdings and benefit contributions. Adopting standardized record-keeping procedures creates consistency and clarity in documentation.

- Implement digital storage: Transitioning from manual record-keeping to digital storage solutions is transformative. Digital platforms not only enhance the accessibility and security of records but also facilitate efficient retrieval during audits or internal reviews. Cloud-based storage solutions, in particular, offer accessibility from anywhere, ensuring that records are readily available when needed.

10. Non-compliance with labor laws

Violating labor laws related to minimum wage, overtime, or other employee rights can result in legal consequences. Stay informed about labor laws, conduct regular training for payroll staff, and seek legal advice to ensure compliance with evolving regulations.

Addressing these common payroll errors requires a proactive approach, continuous education on relevant payroll laws, and the implementation of robust payroll management practices.

Here’s what you can do to avoid this mistake:

- Seek legal advice: In complex legal matters, seeking professional advice is crucial. Establish a relationship with legal experts specializing in employment law to guide compliance matters.

- Be proactive: Addressing common payroll errors related to labor law violations necessitates a proactive approach. This includes developing and consistently applying standardized procedures for wage calculations, overtime tracking, and record-keeping.

- Continuous education: Continuous education on relevant laws and regulations is an ongoing process. Payroll staff should be encouraged to stay informed and adapt to changes swiftly.

By adopting a proactive stance, fostering continuous education, and seeking legal guidance, businesses can navigate the complexities of labor laws in payroll management. This approach minimizes the risk of errors and demonstrates a commitment to ethical employment practices and regulatory compliance.

Payroll mistakes have serious consequences

So why is it essential to eliminate the common issues small businesses face regarding payroll? Even small mistakes have costly consequences.

For example, in a lesson from Seth Bannon during his time as Founder and CEO of Amicus, Bannon describes how a payroll mistake nearly cost him his business:

“I hired our first accountant this year… He noticed there hadn’t been any payroll tax payments coming out of our bank account. Impossible, I thought, Bank of America’s payroll system automatically withholds payroll taxes every month, it’s all automated. But it wasn’t… Cleaning up this mess cost the company over half a million dollars.”

When Preston Demolition made a simple payroll mistake that led to an employee being shorted $608 of overtime pay, the ensuing legal proceedings cost the company more than $40,000 in awards to the employee and responsibilities for paying for the employee’s legal fees.

Unfortunately, these types of mistakes aren’t uncommon. Bloomberg BNA estimates that U.S. businesses paid nearly 7 billion in IRS penalties in 2013 alone due to payroll mistakes.

In better news, the solution to the biggest payroll challenges doesn’t have to be complex. You just need the right payroll software: a tool that makes it easier for your payroll administrator to comply with regulations, collect timesheets, and pay employees the correct amount every time.

What do payroll professionals need from their payroll software?

A 2018 survey from Kronos uncovered the three most-desired features of payroll software:

- On-demand reporting and analytics

- Seamless integration with time and labor management

- The ability to track multiple worker classifications

To keep up with the impacts of the changing workforce on payroll, your company needs an online tool that provides detailed reports, tracks time, lets you set up pay periods and set rates, sends payments automatically, and integrates with the other tools and systems your company uses—all for a price your small business can afford.

Simplify payroll with Hubstaff

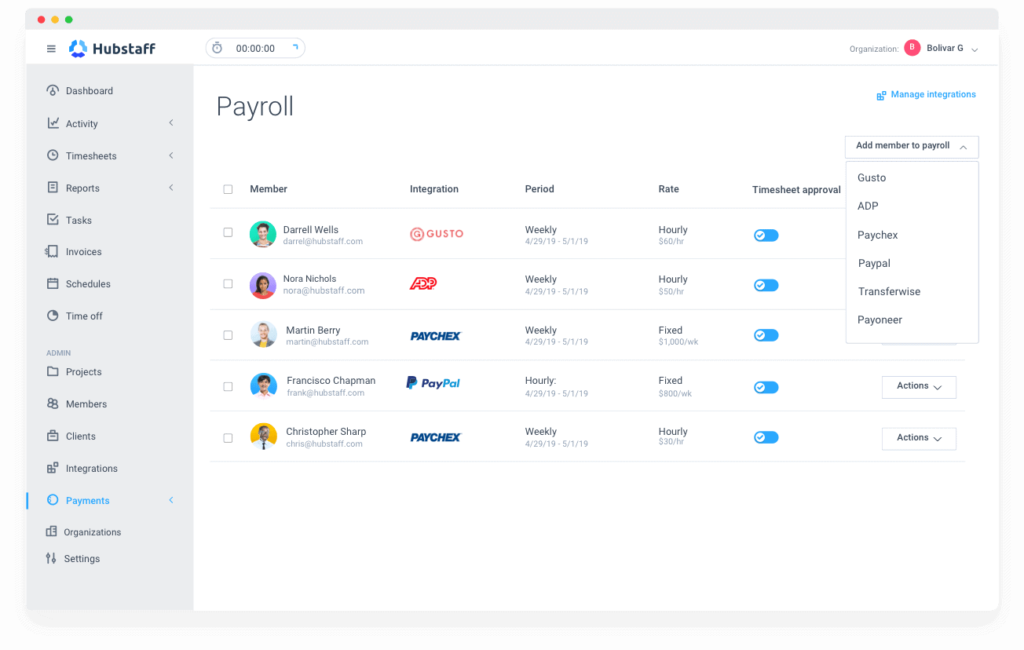

Hubstaff’s time tracking and payroll tools can alleviate many issues small businesses face when paying employees and contractors.

First, Hubstaff is an automated time tracking tool. Hubstaff runs in the background on your team’s desktop or mobile devices, tracking the time they work down to the second. It helps you track overall time worked and time toward specific clients, projects, and tasks, ensuring your payroll checks and client invoices are always accurate.

Second, Hubstaff automatically organizes time tracked into detailed reports. These reports are highly customizable—letting managers and payroll administrators see and pull the necessary information—and can be downloaded or emailed.

Third, Hubstaff lets you set up automatic payroll payments. Simply set pay rates for each employee and establish your pay periods. Hubstaff automatically sends payment to employees—via PayPal, Payoneer, TransferWise, or Bitwage—based on time logged and without any involvement from payroll. But if you want to process payments manually, you can do that, too.

Fourth, Hubstaff integrates with more than 30 other tools and apps. Hubstaff integrates seamlessly with dozens of popular workplace tools and applications, letting you connect the dots between your project management, payment, and help desk tools effortlessly.

Finally, Hubstaff is an inexpensive solution to your biggest payroll problems. The Premium plan includes time tracking, automatic payments, and unlimited integrations, starting at about $10/user per month. That’s less than the cost of the least expensive QuickBooks Online plan and a drop in the bucket compared to what you’ll pay to outsource your payroll needs.

Hubstaff was designed with remote and distributed teams in mind. Hubstaff is a fully remote company that uses its tool to pay a large team of independent contractors.

The benefits of an automated payroll and time tracking solution

Choosing the right tool for your small business payroll solution is critical to the health of your business. Pay miscalculations and violating the Fair Labor Standards Act can cost your company.

The right tool lets you spend less time calculating and manually entering data, reducing the likelihood of common payroll mistakes. It sends payments automatically, ensuring employees receive the correct pay for every pay period — no more payment errors that can cost your organization money and damage workforce morale.

The bottom line: the right software reduces the overwhelming administrative work of managing payroll. With software, you can reduce payroll errors and ensure your’re processing payroll correctly every time.

That means your payroll managers have more time to focus on getting things right and avoiding costly mistakes. And those who manage payroll on top of their other responsibilities can spend less time manually pulling timesheets and sending payments—and more time on the types of tasks that truly move the needle for your business.

Subscribe to the Hubstaff blog for more posts like this

Most popular

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...

The AI Productivity Panel: Lessons From Leaders on What’s Working (and What’s Not)

When I moderated this AI productivity panel, I expected a solid conversation. What I didn’t expect was the flood of real-world i...

Employee Performance Dashboards: Templates, Tools, and Best Practices

Keeping track of how your team’s really doing can be tricky. Spreadsheets pile up, one-on-ones only tell part of the story, and...