Finding the right DCAA-compliant time tracking software can be the difference between passing an audit and scrambling to explain missing records.

Not every tool is built with federal oversight in mind, so when you're dealing with cost-reimbursable contracts or T&M billing, there’s little room for error.

At a minimum, any software you choose should support the key mechanics of DCAA compliance:

Daily entries

Approval flows

Secure logs

Audit-ready exports.

Some systems make these features easy to manage, while others bury them behind clunky workflows or lack them altogether. The details matter.

If you’re evaluating options, here are the features that matter most:

Audit trail. You need a system that logs every action (time entries, edits, approvals) along with who made them and when. If someone changes a timesheet after submission, the tool should capture that change and require a reason for it to create a better audit trail.

Supervisor approvals. Timesheets should move through a defined approval process before being finalized. That review step (where a manager reviews and signs off on time entries) is a core part of DCAA's expectations.

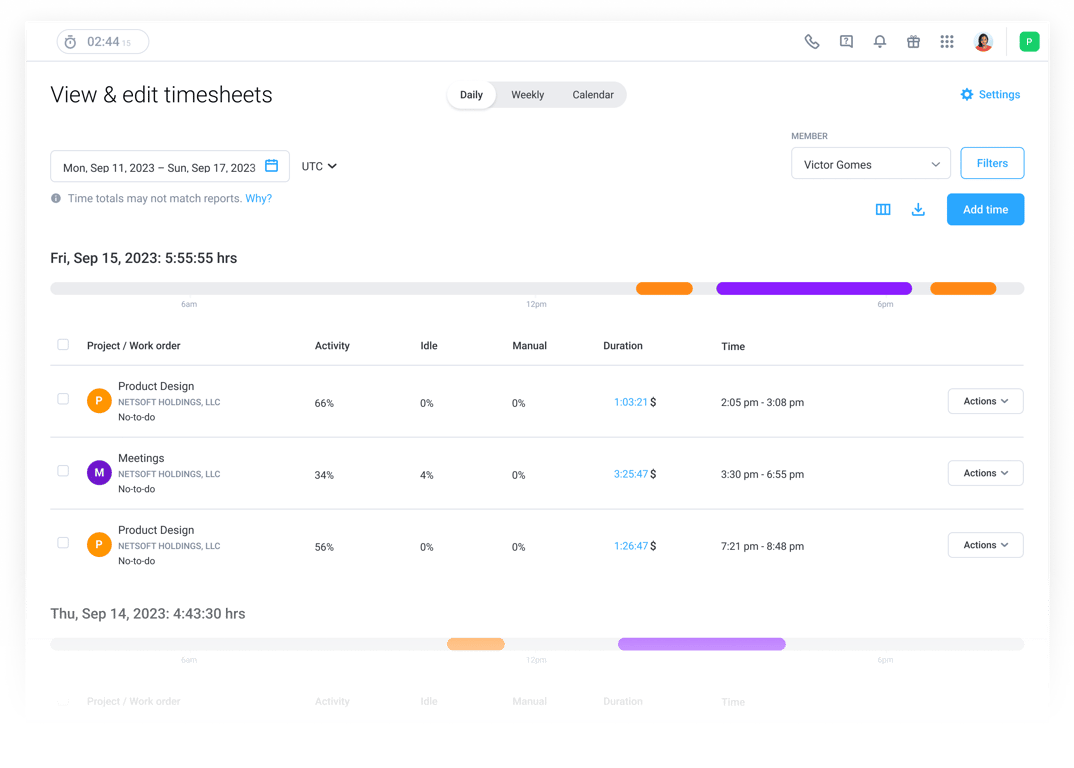

Daily entry support and reminders. If employees are entering time once a week (or forgetting altogether), that’s a problem. Good software encourages or enforces daily entries, often with built-in reminders to keep things on track. The best tools generate timesheets in real-time.

Secure access controls. You don't want employees viewing or editing other timesheets. A DCAA-compliant system will offer role-based permissions so each user only has access to the timesheets for which they're responsible.

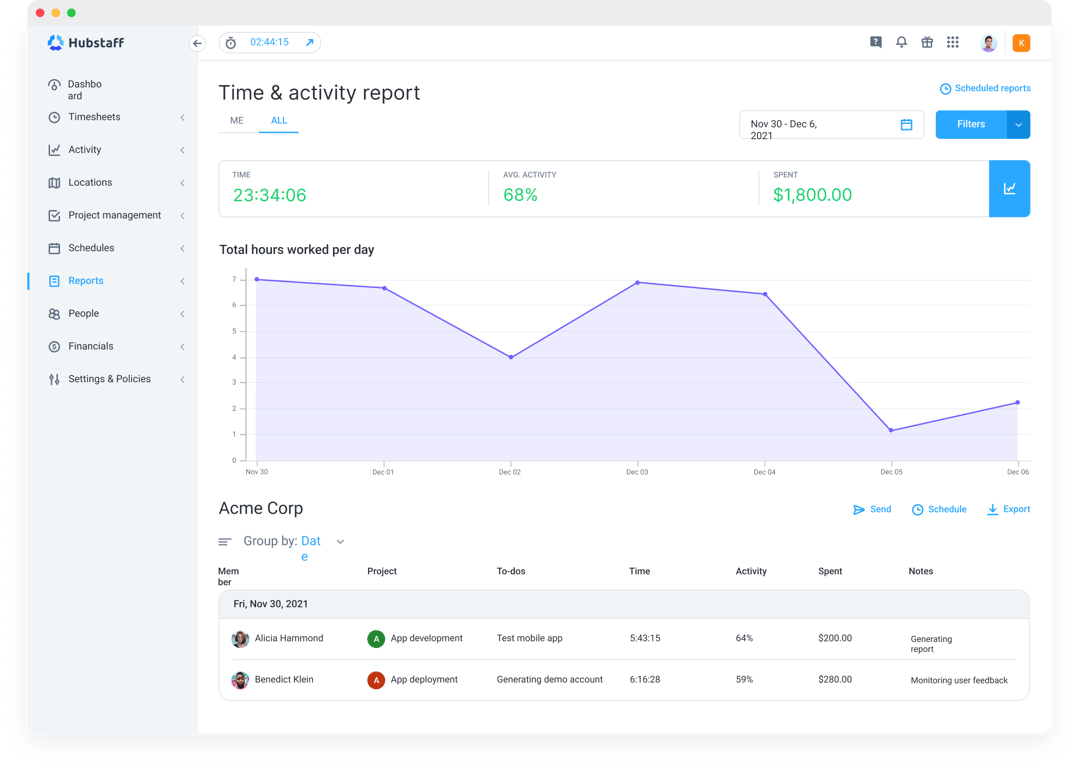

Easy reporting and exports. If you get audited, you'll need to hand over clean records. The system should let you export reports in PDF or spreadsheet formats with all approvals, timestamps, and edit logs included.

A few other features can help, like time period locks (to prevent edits after approval) or restrictions around manual time entry. These aren't strictly required, but can reduce risk.

Hubstaff checks all the boxes above. It tracks time in real-time, allows for daily logs, and keeps a secure audit trail that shows every change — including who made it and why.

Employees certify their hours, supervisors approve them, and the system retains records for as long as needed. You can also set user permissions, restrict manual edits, and generate detailed time reports that stand up to scrutiny.

Employees certify their hours, supervisors approve them, and the system retains records for as long as needed. You can also set user permissions, restrict manual edits, and generate detailed time reports that stand up to scrutiny.

While no software can guarantee compliance on its own, tools like Hubstaff can make it much easier to build and maintain a process that stays within DCAA’s lines.