It’s important to distinguish between exempt vs. nonexempt employees correctly if you’re an employer. Knowing the differences protects you from violating the Fair Labor Standards Act and paying financial penalties.

Here’s a look at what makes exempt vs. nonexempt employees distinct so you can stay compliant with federal and state regulations.

Boost your team’s efficiency with Hubstaff's productivity tools

What is the difference between exempt vs. nonexempt employees?

The difference between exempt and non-exempt employees is that exempt employees are generally salaried, and management-level staff are exempt from minimum wage and overtime pay requirements. Non-exempt employees often receive hourly pay and are eligible for overtime pay rates.

According to the Fair Labor Standards Act (FLSA), the U.S. Department of Labor (DOL) requires most employees to receive at least the federal minimum wage for their work hours.

The FLSA also mandates that eligible workers are paid overtime, 1.5 times their regular pay rate.

However, these requirements may not apply to exempt employees, such as executives, administrators, professionals, or outside sales roles. Let’s discuss more about what makes an employee exempt.

What is an exempt employee?

Exempt employees are often referred to as “white-collar workers.”

Examples of exempt employees

Employees exempt from minimum wage and overtime pay requirements include:

- Executive employees: This category includes salaried team members who lead organizations and have the authority to hire and fire other employees.

- Salaried administrative employees: These are workers who handle general business operations.

- Professional employees: Those whose job duties require specialized or advanced knowledge, such as creative professionals or researchers.

- Computer employees: These jobs include programmers, analysts, or engineers.

- Outside sales employees: Team members on the road, primarily making sales or handling orders.

Pros and cons of being an exempt employee

Pros:

- Salary stability: Exempt employees often receive a fixed salary, providing financial stability regardless of hours worked.

- Career advancement: Exempt status is often associated with professional roles that offer career growth and advancement opportunities.

- Flexibility: Exempt employees may have more flexibility in managing their work schedules, allowing for better work-life balance.

Cons:

- Potential for long hours: Exempt employees may be expected to work beyond standard hours without overtime pay.

- Limited overtime compensation: Exempt employees are generally ineligible for overtime pay, potentially leading to uncompensated extra work.

- Lack of flexibility in scheduling: Some exempt roles may be expected to be available outside regular hours, reducing flexibility in work hours.

Tax implications for exempt employees

Exempt employees, typically salaried professionals, experience specific tax implications compared to their non-exempt counterparts. One significant aspect is that exempt employees are not eligible for overtime pay, as they are exempt from the Fair Labor Standards Act (FLSA) regulations governing overtime eligibility.

While they enjoy the stability of a fixed salary, exempt employees should know that their income is subject to income tax withholding, Social Security, and Medicare taxes. Additionally, they may have opportunities to contribute to tax-advantaged retirement plans, such as 401(k)s, which can affect their taxable income.

Understanding the tax implications of their exempt status enables employees to make informed financial decisions and take advantage of available tax benefits.

What is a nonexempt employee?

A non-exempt employee often engages in “blue-collar” work.

Examples of nonexempt employees

This type of employee includes:

- Anyone paid hourly wage or salary who performs manual labor or work that requires repetitive operations (such as factory or line work)

- First responders, including police, fire department personnel, and paramedics

- Employees who collect a salary or payment at an hourly rate that results in less than $684 per week in wages

Pros and cons of being a nonexempt employee

Pros:

- Overtime pay: Nonexempt employees are eligible for overtime pay for hours worked beyond the standard pay period.

- Hourly pay flexibility: Nonexempt employees may receive hourly wages, providing more immediate and variable compensation based on actual hours worked.

- Clear expectations: Nonexempt employees typically have more clearly defined work hours, reducing the expectation of working beyond a standard schedule.

Cons:

- Variable income: While hourly pay can provide flexibility, it also means that income may vary based on the number of hours worked.

- Limited flexibility: Nonexempt employees may have less flexibility in managing their work schedules than their exempt counterparts.

- Overtime constraints: Employers may closely monitor and limit overtime hours to control labor costs, potentially affecting income opportunities for nonexempt employees.

How to classify exempt vs. nonexempt employees

Under the FLSA, employees may have an exempt classification if they are:

- Paid a salary for performing a supervisory or management role in an administrative or executive position

- Given a salary for performing professional services that require specialized knowledge or instruction

- Salespeople are paid by salary or on a fee basis for performing work predominantly away from the place of business

- Salaried computer personnel

According to federal guidelines, each position requires the employee to earn at least $684 weekly.

The importance of classifying employees correctly

The correct classification of whether an employee is exempt or nonexempt holds crucial importance for employers and workers.

For employers: Proper classification ensures adherence to labor laws and regulations, avoiding legal complications and potential financial penalties for employers.

For employees: Accurate classification determines entitlements such as overtime pay, benefits, and legal protections. Whether intentional or unintentional, misclassification can lead to dissatisfaction, legal disputes, and financial consequences.

Salary vs. hourly pay

Salary refers to a payment method in which employees receive a set pay rate for their work, regardless of the hours worked.

Salaried employees are often exempt from overtime pay laws. But they generally have more say about when they work. Salaried employees may have to work more than 40 hours a week.

Because of this, personal time and work time for the salaried employee often blend. Managers need to ensure they emphasize work-life balance for salaried workers.

Employees paid on a salary basis are often eligible for employer-provided benefits. These include health insurance, retirement plans, and paid time off, which hourly employees may not receive.

For hourly employees, one of the most significant benefits is receiving overtime. However, hourly employees are only sometimes eligible for health, retirement, and other benefits, such as paid family leave.

Read about the differences between hourly and salaried employees here.

Exempt vs. nonexempt employees: Which is better?

From an employer’s standpoint, an exempt employee generally commands a higher salaried pay than a nonexempt one. Exempt employees are preferred in positions often requiring them to work over 40 hours a week or flexible hours.

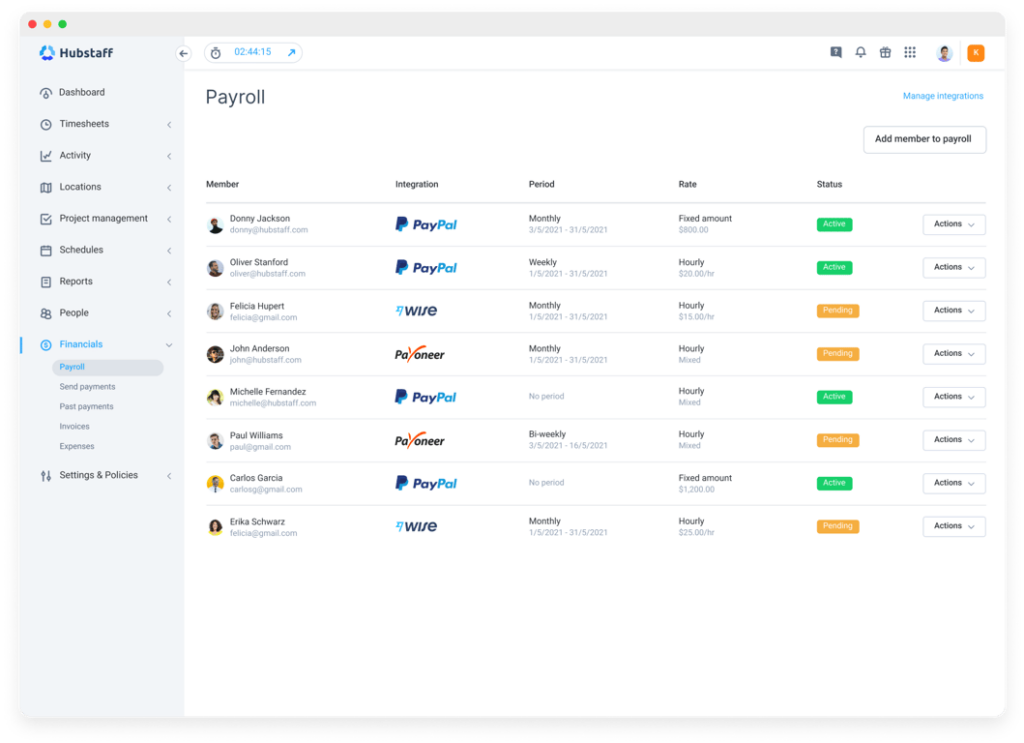

Having nonexempt and hourly employees means following timekeeping requirements to ensure your team members obtain overtime pay for hours exceeding the 40-hour workweek. Most employers use one of these options:

- A time clock that records when the employee “clocks in” and “clocks out” of work

- Timekeepers, whose positions consist of recording the hours that employees work or entering timecards into a time management system

- Time tracking software, such as what Hubstaff offers

Hubstaff’s time tracking tools include creating and managing employee schedules, tracking overtime hours, invoicing clients, and automating payroll.

Track your employees’ time easily with Hubstaff

Keeping track of the time your full-time and part-time employees work is integral to complying with FLSA regulations.

Hubstaff’s all-in-one time tracker app can quickly help your human resources team manage salaried and hourly workers. It’s easy to view schedules, shifts, paid time off, in-depth reports, and more.

Take it for a test drive with our free 14-day trial.

FAQs

Are exempt employees the same as salaried employees?

While salary pay is one of the criteria for determining exempt vs. nonexempt employees, that is not the only criterion. Exempt employees must be salaried. But in addition to the salary requirement, their wages must equal at least $684 per week. Also, according to the definitions listed above, they must be an executive, administrative, professional, outside sales, or computer employee.

Employees must pass what two tests to be considered under FLSA?

To determine if your employee can be considered exempt, they must pass these two tests:

- The salary basis test: The employee must earn at least $684 weekly.

- The duties test: The worker must have an executive, administrative, professional, computer, or outside sales role.

What makes an employee exempt in California?

California state law has additional employee categories exempt from the federal minimum wage and overtime pay requirements.

In addition to the exemptions in FLSA, other types of exempt employees in California include:

- Any employee who is the employer’s parent, spouse, child, or adopted child

- Individuals participating in a national service program such as Americorps

- Drivers whose hours are regulated by the U.S. Department of Transportation

- Employees with a collective bargaining agreement that explicitly provides for wages, hours of work, and working conditions

- Employees earning at least half their pay in commissions that result in earnings equaling one and one-half times the federal minimum wage

- Taxicab drivers

- Airline employees working more than 40 but no more than 60 hours a week due to a temporary modification to their work schedule

- Carnival ride operators who work full-time for a traveling carnival

- Any person over the age of 18 who is a babysitter for a minor child in the employer’s home

What does exempt mean for taxes?

The IRS does not view exempt vs. nonexempt employees differently regarding taxes. It calculates earned income the same way, regardless of the employment status. Also, the employer is responsible for local, state, and federal tax withholdings for exempt and nonexempt employees.

Most popular

How Many Meetings Are Too Many? 2026 Benchmarks by Role

How many meetings are too many? In 2026, the honest and boring answer is: it depends on your role. Our 2026 Global Trends and Benc...

When Evening Work Becomes a Red Flag: How to Fix Triple-Peak Overload with Smarter Core Hours (2026 Data)

Most people don’t remember the first time they worked in the evening, and even fewer people know when the last evening work sess...

How Much Deep Work Do Employees Really Get?

Employees are more distracted than you think — and it isn’t due to lack of discipline. In fact, the blame falls far from them:...

What AI Time Tracking Data Reveals About Productivity in Global Teams (2026)

Global teams face one problem, and it isn’t total hours worked. Measuring time spent in meaningful, focused work can be a challe...