Global payroll compliance is more than a back-office function these days. Modern businesses operate globally, and that provides significant advantages — but not when it comes to payroll.

With team members around the globe, the stakes are high for payroll professionals attempting to keep up with every country’s global employment laws. Without the right global compliance systems in place, organizations expose themselves to serious risks, including:

- Misclassification

- Late payments

- Tax penalties

- Regulatory violations

In this post, we’ll explore how businesses can streamline global payroll and compliance, reduce risk, and future-proof workforce management.

To provide real-world experience, we’ve roped in Vic O’Callaghan, Director of Global Payroll Presales Delivery at Deel. She will share tips on integrating time tracking and payroll platforms like Hubstaff and Deel.

Boost your team’s efficiency with Hubstaff's productivity tools

What is the biggest challenge organizations are facing with a global workforce today?

The biggest challenge with managing a global workforce is undoubtedly the sheer complexity.

With a foreign team, you’ll need to adapt to regional payroll regulations, holidays, and work habits. From contractor-specific compliance to full-time employees, the list of different requirements is long.

If you find yourself in this scenario, the right global HR payroll system can be a game-changer for scaling faster.

According to the Hubstaff executive playbook for BPOs, AI-driven solutions have helped reduce compliance-related errors by 60%. Processing efficiency has improved by 40%.

Without the proper expansion strategies, companies scaling rapidly across borders often face increasing challenges in managing global payroll effectively.

According to Vic O’Callaghan, Director of Global Payroll at Deel, one of the biggest challenges organizations with a global workforce face today is the complexity and fragmentation of payroll systems across multiple regions.

As companies expand internationally, they often accumulate a patchwork of local vendors, systems, and processes that are difficult to unify.

This fragmentation creates major inefficiencies — making it difficult to get a consolidated view of payroll expenses or ensure consistent compliance with local regulations.

Vic highlights several key challenges facing global payroll operations, like:

- The need for clean, accurate data across all regions

- The complexity of managing country-specific payroll regulations

- A reliance on deep local expertise to ensure compliance

- Limited internal resources, which can lead to payroll delays, mistakes, and compliance risks.

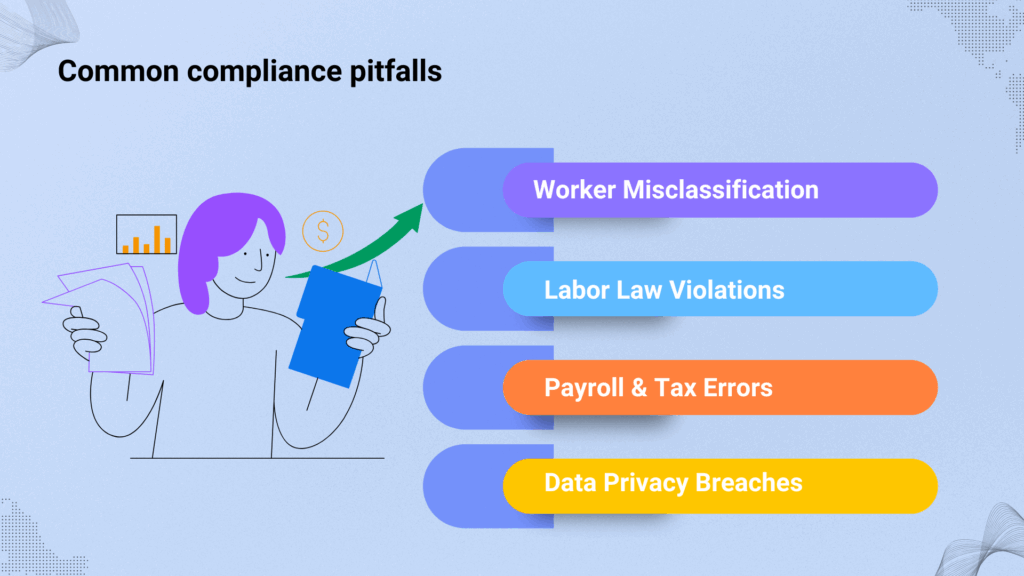

What are some of the biggest compliance risks companies face when expanding their team internationally?

Companies face many compliance risks when expanding internationally, which are tied to varying labor laws, tax regulations, and social security requirements.

“Each country has its own unique set of laws and regulations, which can be overwhelming for companies trying to stay compliant while expanding internationally. “ – Vic O’Callaghan, Director of Global Payroll Presales Delivery at Deel.

One of the most common pitfalls in global payroll is failing to stay up to date with local regulations, which often change and may include:

- Complex and variable tax rates

- Mandatory health and social benefits

- Detailed reporting and documentation requirements

- Strict payroll submission and payment deadlines

Vic also highlights the risks around worker classification — particularly the distinction between independent contractors and full-time employees. If mismanaged, this can result in serious legal and financial consequences.

Without deep local expertise, businesses can quickly be exposed to audits, penalties, or reputational damage.

What is payroll and compliance?

Payroll compliance refers to lawfully following local, state, and federal regulations while hiring and paying international employees. Businesses that fail to abide by these laws risk facing penalties, which can hurt their bottom line or, in severe cases, threaten their ability to stay in business.

How can employers avoid global payroll and compliance risks?

The first step to avoiding global payroll management and compliance pitfalls is to be proactive and take a tech-enabled approach. This is a complex terrain that requires reliable partners to navigate.

“Companies should invest in a comprehensive compliance tool and partner with providers that offer continuous monitoring of regulatory changes.” – Vic O’Callaghan, Director of Global Payroll Presales Delivery at Deel

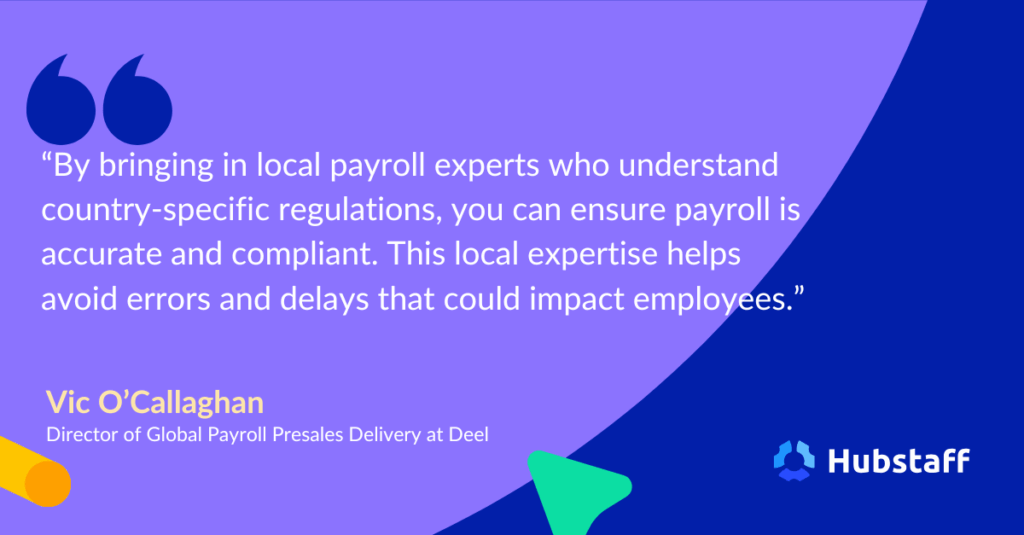

Vic also emphasizes the importance of tapping into local expertise through in-country specialists or global payroll solutions that embed local knowledge.

“It’s important to have people who understand the nuances of each country’s laws and can help navigate the compliance landscape.” – Vic O’Callaghan, Director of Global Payroll Presales Delivery at Deel

In addition, automating processes with payroll software and centralizing systems can dramatically reduce risk.

Companies can simplify operations and reduce manual oversight with platforms that help:

- Centralize payroll, compliance, and legal requirements in one place

- Automate tasks to reduce manual errors and oversight

- Stay updated with real-time regulatory changes

- Leverage local expertise built into global solutions

- Scale confidently while staying compliant across borders

The right mix of technology, expertise, and real-time intelligence can help businesses stay compliant and confidently scale their international teams.

How can businesses navigate compliance requirements in different countries for a positive employee experience?

Businesses with distributed teams often deal with complex compliance checklists, but they shouldn’t affect the employee experience. The key is finding the right balance between operational accuracy and employee trust.

Global compliance management is even more crucial for enterprises with larger teams, as they often operate in multiple jurisdictions worldwide.

Here are Vic’s top strategies for staying compliant while keeping your team informed and supported:

- Leverage local payroll expertise. Working with local payroll experts who understand each country’s payroll regulations can help avoid costly errors and ensure timely payments.

- Centralize and clean your data. Before transitioning systems, ensure payroll data is accurate and unified to prevent discrepancies and delays.

- Automate payroll processes. Streamline operations, reduce manual errors, and accelerate payroll runs for a smoother, more efficient experience.

- Monitor compliance in real time. Use tools that track legal changes across jurisdictions to stay ahead of updates that could impact payroll or benefits.

- Communicate clearly with employees. Transparent communication about pay, taxes, and benefits builds trust and enhances employee satisfaction.

By combining localized expertise, consolidated global payroll systems, automation, clean data practices, and clear communication, companies can stay ahead of compliance requirements.

This approach also ensures employees a consistent, positive experience — regardless of location.

What is the future of global payroll in the next 3-5 years, and what should companies be doing now to prepare?

When asked this question, Vic highlights that global payroll will grow more complex as companies expand into new markets.

Managing compliance, systems, and data across multiple countries will require greater coordination, visibility, and long-term planning. The positive impact that powerful HR software can have on your global team is non-negotiable.

To stay ahead of the curve, Vic recommends companies begin preparing now by focusing on these core strategies:

- Bring their payroll data in one place before migrating to a new platform so there are no issues during implementation.

- Invest in scalable global payroll solutions that can grow with the business and adapt to new countries and regulatory environments.

- Plan for a longer, phased implementation process when moving to a global payroll solution.

- Companies must be ready for this long-term commitment regarding time and resources.

“For enterprise businesses, implementation can take anywhere from six months to two years, depending on the number of countries involved,” she adds.

It starts with implementing tools like workforce planning software. From there, payroll transformation should be approached not as a quick fix, but as a strategic, multi-phase initiative.

This requires time, dedicated resources, and alignment across functions. However, with proactive planning, businesses can build the infrastructure to manage global payroll efficiently and position themselves for success over the next 3–5 years and beyond.

How payroll and compliance integration tools help bridge the gaps in global team management

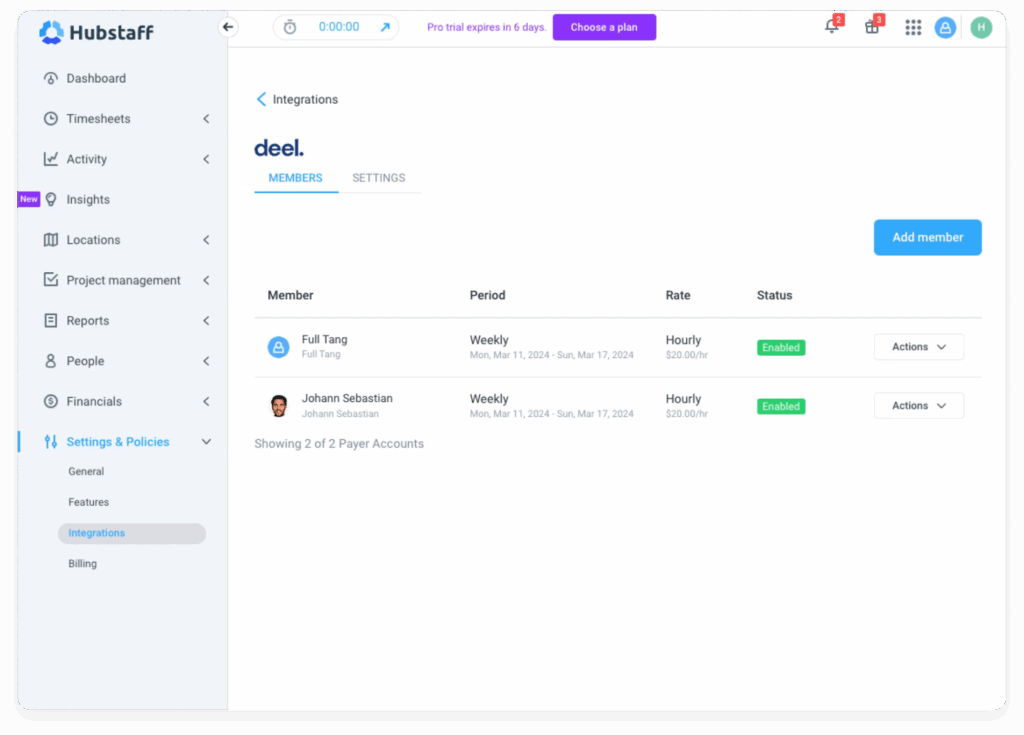

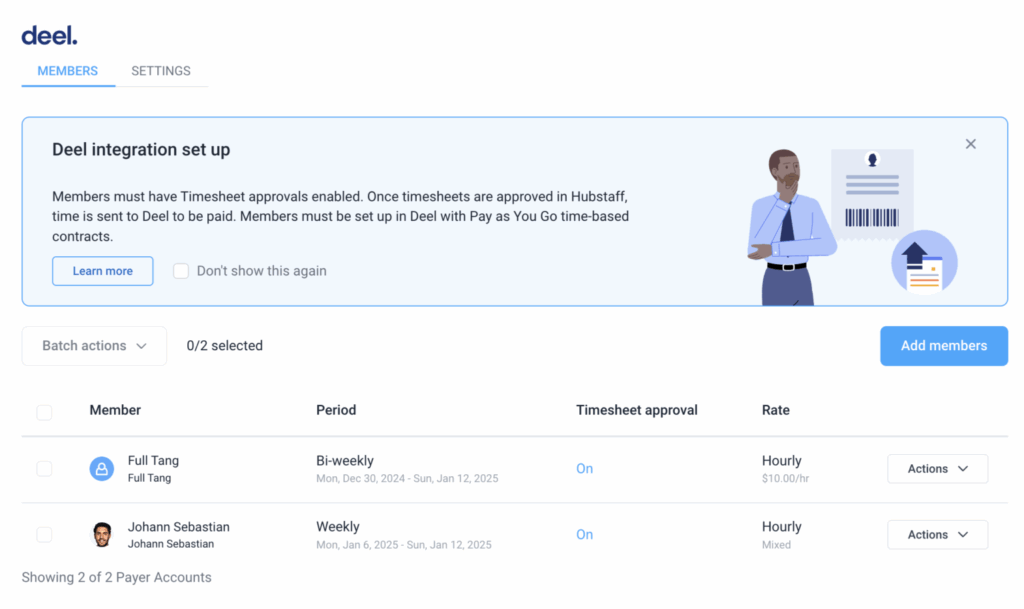

Managing a global team doesn’t have to mean juggling multiple tools. With the Hubstaff + Deel integration, teams can track time, approve timesheets, and automate payroll — all from a single dashboard. Deel and Hubstaff ensure productivity for global teams, offering peace of mind to businesses needing visibility and talent management.

“By combining Hubstaff’s time-tracking features with Deel’s global payroll system, businesses can track time, approve timesheets, and process payments all in one spot. There is no more switching between different tools or worrying about mistakes.” — Vic O’Callaghan, Director of Global Payroll Presales Delivery at Deel

What this integration delivers:

- End-to-end workflow efficiency. Now businesses can track work hours in Hubstaff, approve timesheets, and seamlessly transfer that data into Deel for payroll processing, eliminating the need for manual handoffs and redundant systems.

- Synchronized payroll periods and contracts. The integration aligns payroll periods and manages hourly contracts across both platforms to ensure consistency and accuracy.

- Streamlined setup and data flow. The quick Deel payroll setup and configuration process lets you connect Hubstaff with Deel, authenticate, and sync timesheets in seconds for faster, more accurate payroll.

- Secure, compliant, and global-ready. The integration streamlines payroll in a way that’s efficient, secure, compliant, and designed to scale with distributed teams.

With Hubstaff’s powerful time tracking and Deel’s global payroll and compliance capabilities, companies can:

- Minimize operational friction

- Eliminate costly payroll errors

- Gain complete visibility and control across teams

Whether teams are remote, hybrid, or spread across multiple countries, this integration helps businesses scale efficiently and confidently — without compromising accuracy or compliance.

Global workforce management FAQs

What is global workforce management?

Global workforce management is the process of managing distributed teams across multiple countries. It often includes:

- Tracking employee time

- Managing global payroll

- Gauging remote employee performance

- Optimizing schedules across time zones

- Managing global compliance

For efficient global workforce management, you’ll need to establish a strategy, implement the right tools, and design a set of workflows and systems to streamline global collaboration.

What does workforce management do?

Workforce management ensures that the right people are in the right roles and are paid in an accurate, timely manner. It involves time tracking, payroll, budget forecasting, labor law compliance, and overall workforce optimization to improve productivity and reduce operational risk.

Who is the owner of workforce management?

In most organizations, workforce management is overseen by HR or operations leadership, often in collaboration with finance and compliance teams. For global companies, this may include regional HR leads, payroll managers, or external partners specializing in international employment compliance.

What is an example of a global workforce?

A global workforce could look like a U.S.-based company with developers in India, virtual assistants in The Philippines, and marketing contractors in Canada. These teams often operate across time zones, languages, and legal frameworks.

How do you stay compliant while hiring internationally?

To stay compliant while hiring global talent, companies must ensure they follow each country’s employment laws, tax regulations, and classification rules. This often requires local expertise, real-time legal updates, and tools that automate compliance tracking — like Deel’s global payroll platform.

Why is payroll integration important for global teams?

Payroll integration is essential for businesses with global teams. When time tracking software like Hubstaff is integrated with payroll platforms like Deel, logged hours are automatically converted into timesheets, triggering seamless, on-time payments for international employees and contractors.

This integration reduces errors, eliminates manual processes, and ensures accurate and timely payroll. It also enhances visibility and supports compliance — a crucial advantage when managing workforces across multiple countries and jurisdictions.

Final Takeaway: Deel and Hubstaff are on a shared mission to streamline payroll and compliance for global teams

The future is already here. As teams become increasingly distributed, managing a global workforce is a present-day necessity. Businesses need modern tools and strategies to manage payroll, compliance, and operations at scale.

Through insights from experts like Vic O’Callaghan and the right technology, you can learn to:

- Consolidate fragmented payroll processes

- Reduce compliance risks

- Ensure employees are paid accurately and on time

By aligning time tracking with automated global payroll, companies can minimize errors, reduce manual work, and confidently support a growing international team — especially with help from the right tools.

If the constantly changing landscape of global payroll has your team feeling stagnant, try the Deel and Hubstaff integration to take your business to new heights.

Most popular

Hidden AI Usage in the Workplace: What Your Tools Don’t Tell You

How much has AI changed your team’s work? On the surface, work might not look that different. The meetings are still there, docu...

How Many Meetings Are Too Many? 2026 Benchmarks by Role

How many meetings are too many? In 2026, the honest and boring answer is: it depends on your role. Our 2026 Global Trends and Benc...

When Evening Work Becomes a Red Flag: How to Fix Triple-Peak Overload with Smarter Core Hours (2026 Data)

Most people don’t remember the first time they worked in the evening, and even fewer people know when the last evening work sess...

How Much Deep Work Do Employees Really Get?

Employees are more distracted than you think — and it isn’t due to lack of discipline. In fact, the blame falls far from them:...