Managing remote and hybrid teams brings incredible opportunities, but also a hidden challenge: visibility. In many cases, that gap in visibility becomes filled in with timesheet fraud.

The problem isn’t always malicious, though. Sometimes, it’s blurred numbers, unclear workflows, or friction in the tools. Other times, it’s deliberate padding that distorts capacity data and payroll. Either way, small inconsistencies can snowball into major compliance risks.

In this post, we’ll break down:

- The most common forms of timesheet fraud

- What they cost teams

- Compliance standards and legal issues to be wary of

More importantly, we’ll cover how leaders can protect their organizations with smarter processes and better visibility without skewing toward micromanagement. But first, let’s get a better grasp of what timesheet fraud is.

See Hubstaff in action

Watch our interactive demo to see how Hubstaff can help your team be more productive.

What is timesheet fraud?

Timesheet fraud is the intentional misreporting of work hours to get paid for hours not actually worked. It can appear in the form of time theft (like clocking in or out early), buddy punching (clocking in or out on behalf of teammates), and inaccurately recording breaks.

If you see this behavior happening at your business, it’s easy to jump to conclusions. However, timesheet fraud is often a data integrity problem rather than a moral failure. Both employees and managers can contribute to it, often because of unclear policies, broken workflows, or outdated technology.

Left unchecked, even small instances of timesheet fraud can distort capacity planning, create legal or compliance risks, and inflate costs.

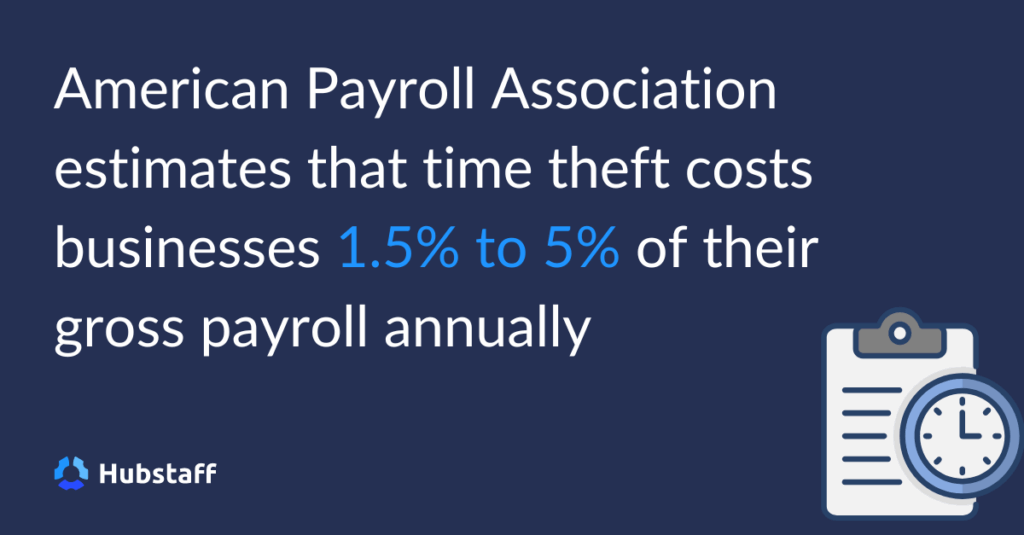

How much does timesheet fraud cost?

The American Payroll Association estimates that time theft costs businesses 1.5% to 5% of their gross annual payroll, which amounts to hundreds of billions of dollars annually.

Another study by the American Payroll Association reported that more than 75% of companies lose money from buddy punching, a practice where one employee clocks in for another.

At the enterprise level, the risk grows quickly.

A few small errors on one team may not seem significant, but spread across distributed teams and global payrolls, the impact compounds. Aside from inflating labor costs, inaccurate time data also distorts team capacity planning, increases audit exposure, and can even raise red flags during investor due diligence.

Of course, the cost of timesheet fraud varies widely from industry to industry and depends mainly on businesses’ strategies to prevent timesheet fraud. We’ll get into those strategies later, but first, let’s explore the most common types of timesheet fraud.

Common forms of timesheet fraud

Timesheet fraud can take many forms. On distributed or hybrid teams, even small inconsistencies can slip through and create bigger problems later.

Here are the most common patterns to watch for:

| Fraud Type | How It Appears in Distributed or Hybrid Teams |

| Inaccurate hour logging | Logging a full day’s work without matching project progress, task output, or deliverables |

| Buddy punching / shared logins | Colleagues logging time or clocking in on each other’s behalf (rare, but still possible remotely) |

| Manual edits to timesheets | Adjusting previously submitted time blocks without explanation or context |

| Time-padding | Staying “active” in time trackers while working on personal tasks or multitasking extensively |

| Unauthorized overtime logging | Logging hours outside approved limits or policies without prior discussion |

| Idle time recorded as active | Leaving systems or apps open while away, resulting in logged but unproductive time |

| Cross-project time reuse | Logging the same hours to multiple clients or contracts in parallel |

| Manager-side timesheet edits | Supervisors modifying time entries post-submission to reduce costs or align with budget targets |

| Logging to incorrect projects | Assigning time to the wrong task, client, or internal workstream |

Is falsifying timesheets a violation of the law?

Yes. In the U.S., falsifying time records is considered a violation of labor law, whether done by an employee or an employer.

The Fair Labor Standards Act (FLSA) requires accurate tracking of hours worked, while the IRS and state labor agencies set strict rules for payroll reporting, tax withholdings, and worker classification.

It’s important to note that intent doesn’t always matter. Even sloppy or inconsistent records can leave a business out of compliance. This, in turn, creates exposure to fines, back pay claims, and audits.

When does timesheet fraud become a felony?

Most cases of timesheet fraud are handled as civil matters, but they can escalate into criminal charges when intent and scale are involved. For example:

- In California, falsifying payroll records exceeding $950 can be charged as a felony.

- Systemic fraud, such as inflating hours for multiple employees, can trigger criminal liability.

- Employers who deliberately falsify records to avoid paying wages or taxes may face fraud charges and significant penalties.

What starts as a recordkeeping issue can quickly escalate into a serious legal problem (sometimes even a criminal one) if inaccurate time data is ignored or (worse) manipulated.

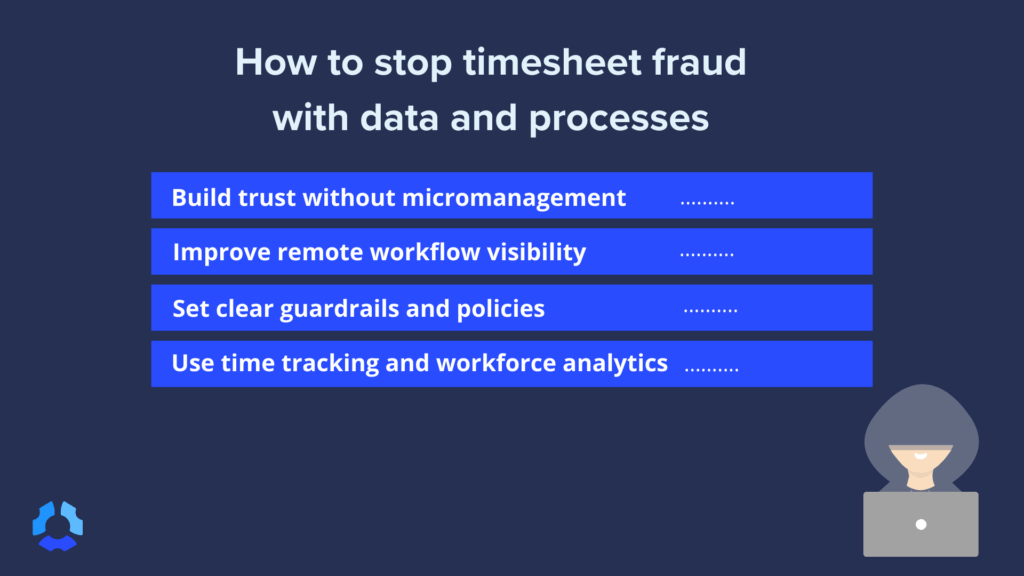

How to stop timesheet fraud with data and processes

Timesheet fraud doesn’t disappear on its own. To prevent it, leaders need processes that make accurate reporting simple and reliable — especially for distributed teams.

The good news is that the same practices that reduce fraud also strengthen trust and improve planning. Here are four ways to build those practices into your workflows.

Build trust without micromanagement

The most effective way to prevent fraud is to start from a place of trust.

When team members feel respected and empowered, they’re less likely to game the system and more likely to flag issues themselves. Leaders should set clear expectations, then step back and let the work speak for itself.

Instead of relying on micromanagement and intrusive monitoring, use lightweight time tracking platform with built-in employee productivity monitoring features as a safeguard. For sensitive projects, consider turning off screenshots, app and URL tracking, and other tracking features altogether so accountability doesn’t come at the cost of privacy.

Improve remote workflow visibility

Fraud often hides in the gaps between your technology and the workflows you’ve built. For instance, if the hours your team has logged don’t align with deliverables in project management tools, it’s a sign that something’s off.

Create simple cross-checks between time data and work outputs so discrepancies stand out early. The goal isn’t to police activity but to keep the data that leaders rely on accurate. Aside from preventing fraud, this visibility also improves planning across the entire organization.

Set clear guardrails and policies

Confusion is one of the biggest drivers of timesheet inconsistencies.

Make sure policies around logging hours (including overtime) are accessible and reinforced regularly. Publish these rules in a shared space so there’s no ambiguity about what’s expected.

You should also automate reporting wherever possible so compliance checks happen without adding extra overhead.

Use time tracking and workforce analytics

Manual oversight can only go so far. To stop fraud at scale, leaders need systems that surface anomalies automatically.

Tools like Hubstaff’s time tracking software platform combine accurate time tracking with built-in productivity monitoring, helping teams spot issues before they grow.

Hubstaff Insights, part of the Hubstaff platform, expands on this with workforce analytics. It includes advanced features like anomaly detection and audit logs. With these tools, leaders can more easily identify patterns that might otherwise stay hidden without constant monitoring.

How Hubstaff Insights helps prevent timesheet fraud

Hubstaff Insights builds on time tracking by showing leaders how time is actually spent across their teams. Instead of searching through spreadsheets or trying to make sense of reports, Insights highlights real-time patterns that show whether hours match the work being done.

Watch the Insights walkthrough:

Among its features, Hubstaff Insights provides:

- Utilization rates. See employee utilization at a glance with comparisons to standard work hours.

- Smart notifications. Flag unusual trends like unexpected overtime or idle stretches so leaders can review them quickly.

- Unusual activity. Identifies suspicious employee activity (like abnormally high keyboard and mouse activity) and other inconsistencies.

With Insights, teams are better able to take ownership of their work, and leaders are confident that the records they’re reviewing are accurate.

How to report timesheet fraud internally

While most timesheet issues aren’t malicious, your goal remains the same: to protect the integrity of your systems.

That said, you shouldn’t call people out. A simple, quiet process keeps things professional and consistent.

- Verify quietly. Compare the time data with project tools like Jira, GitHub, or task trackers to confirm whether the hours line up.

- Document the pattern. Note recurring inconsistencies rather than one-off mistakes.

- Escalate discreetly. If the issue persists, share your findings with HR or Finance for review instead of handling it directly with the individual.

This approach helps leaders correct problems early while maintaining trust and fairness across the team.

FAQ: timesheet fraud

Is timesheet fraud illegal?

Yes. Falsifying time records can violate labor laws, especially when it affects wages, overtime pay, or compliance with tax and payroll regulations. Both employees and employers can be held accountable. Specific consequences depend on the jurisdiction, as labor laws vary by region.

What is timesheet manipulation?

Timesheet manipulation is the intentional alteration of recorded hours. This can mean inflating time worked, shifting hours between projects, or misrepresenting work completion. It may also include buddy punching or time theft.

Can you get fired for timesheet fraud?

Yes. Many companies treat timesheet fraud as a serious policy violation. Even unintentional inconsistencies can lead to disciplinary action, depending on the organization’s rules and requirements.

How do companies detect time theft?

Companies typically use audit logs, project management data, and payroll reports to spot discrepancies. In distributed teams, activity anomalies and manual time approval discrepancies flagged by tools like Hubstaff can also reveal patterns that don’t match project output.

Is it illegal to clock someone in at work?

Yes. This practice, known as “buddy punching,” is considered a form of fraud and can expose both employees and employers to compliance risks.

What are the consequences of timecard fraud?

Consequences can range from written warnings to termination. In more serious cases (especially when payroll records are falsified), legal or financial penalties may apply.

What is the difference between a timecard error and fraud?

An error is unintentional, like forgetting to log out for lunch. Fraud involves knowingly misreporting hours or altering records for personal or organizational gain through buddy punching or time theft.

Conclusion

Timesheet fraud creates two kinds of risk: compliance exposure and productivity loss.

When left unchecked, what appear to be small discrepancies in logged hours can ripple through payroll, capacity planning, and even investor confidence. Hubstaff helps leaders stay ahead of those risks.

With Hubstaff, you can detect time fraud early, ensure compliance, and empower teams with accountability — not friction.

Disclaimer: This post was originally published on February 12, 2024, and last updated on August 27, 2025, to ensure accuracy and relevance.

Most popular

When Evening Work Becomes a Red Flag: How to Fix Triple-Peak Overload with Smarter Core Hours (2026 Data)

Most people don’t remember the first time they worked in the evening, and even fewer people know when the last evening work sess...

How Much Deep Work Do Employees Really Get?

Employees are more distracted than you think — and it isn’t due to lack of discipline. In fact, the blame falls far from them:...

What AI Time Tracking Data Reveals About Productivity in Global Teams (2026)

Global teams face one problem, and it isn’t total hours worked. Measuring time spent in meaningful, focused work can be a challe...

How AI Is Transforming Workforce Analytics: A Roadmap for Team Leaders

Why do you think most leaders struggle with managing their teams? While many believe it’s a lack of data, AI workforce analytics...