A consistent payroll process is the key to retention and attracting top talent in your respective industry, but how do you know how many pay periods in a year?

Unfortunately, there’s no simple answer. Each pay frequency has its share of advantages and disadvantages. The important thing is to consider your unique circumstances.

When choosing how many pay periods you’ll use, you’ll need to make the choice that:

- Establishes better cash flow

- Ensures legal compliance

- Helps employees budget better

- Prioritizes employee experience

- Accounts for added overtime costs

In this post, we’ll delve into the positives and negatives of an array of different pay periods to help you choose the one that works best for you and your business. Ready to maximize payroll processing?

Boost your team’s efficiency with Hubstaff's productivity tools

How many pay periods in a year?

The total number of pay periods in a year for you may vary depending on the payment schedule you follow for payroll.

- Daily pay periods in a year. If your company follows a daily payment schedule, the total number of pay periods in a year would be around 260. However, the number may vary depending on the days your employees or third-party human resources were active for work.

- Weekly pay periods in a year. If your company follows a weekly payment schedule, you’ll have 52 pay periods in a standard year. The number may vary depending on your industry, as your workforce might not work year-round.

- Biweekly pay periods in a year. There are 26 pay periods on the biweekly model. However, some exceptions may occur based on your operations or regulatory requirements.

- Semi-monthly pay periods in a year. If your company follows a semi-monthly payment structure for its employees, there are 24 pay periods. Like any other pay period model, this depends on state laws and each organization’s unique needs.

- Monthly pay periods in a year. As you might expect, there are 12 monthly pay periods in a year. However, more seasonal examples used above, like the education field, might use a 10-month model.

What is a pay period?

A pay period is a consistent time frame that determines workers’ wages and frequency of pay. Pay periods are important because they determine the dollar amount and number of paychecks companies will use to pay an employee on payday.

The length of a pay period may vary from one company to another based on various factors and regulatory policies. Plus, a company may have different employee pay periods for different employees based on the nature of their jobs or a mutually agreed-upon payment schedule.

Creating a well-thought-out payment schedule and sticking to it is a must to ensure business growth, as it allows you to ensure compliance with regulatory requirements and avoid violations that may lead to hefty penalties.

Your pay schedule may serve as a key factor that sets you apart from the competition in your respective industry and helps you attract and retain top-tier talent. Let’s explore the types of pay periods companies use.

Types of pay periods

There are many different types of pay period schedules that a company might choose from — and each has its advantages and disadvantages for both employees and employers. We won’t get into every option in existence, but here are some of the most common pay periods. First up: the daily pay period.

Daily pay period

Companies are least likely to prefer daily pay dates, as they require you to pay employees each day they work.

Companies often avoid using this method due to the complexities associated with payroll calculation. If not managed properly, it can also lead to company cash flow concerns.

For employees, daily pay is helpful as it allows for better cash flow for household budgets, commuting costs, and other unexpected expenses.

Weekly pay period

A weekly pay schedule also benefits part-time, seasonal, or lower-wage hourly employees as it allows them to access payments more frequently.

Biweekly pay period

A biweekly pay schedule is a cycle that repeats every other week, resulting in 26 pay periods in a standard year. This method makes for easier payroll management and better cash flow, making it a popular choice for mid-sized and large enterprises with salaried employees.

Semi-monthly pay period

Not to be confused with a biweekly pay period, a semi-monthly pay period spans 15 days. In this pay period structure, payments are made on the 15th and the last day of the month.

Companies may follow this pay structure regardless of size, but it’s readily adopted by those representing the industrial sector.

Monthly pay period

Since the payment interval is quite long, a monthly payroll calendar can reduce administrative costs and make payroll management quite easy for the companies. However, while setting up a monthly payroll calendar can make life easier for your organization, employees might not be too thrilled that they’re only getting paid once a month.

Custom pay period

A custom pay period is a looser payment model that allows employees to withdraw payments outside of more commonly used weekly, biweekly, or monthly pay periods.

You might see custom pay periods come into play when employees need to withdraw their salaries in advance. For example, if an employee is terminated from a particular position, they might be able to receive any outstanding payments at that time.

The laws or regulations that apply to a particular region play a major role here. So, companies may have to develop custom or need-based pay periods to maintain compliance under the Fair Labor Standards Act (FLSA).

Fixed-length pay period

Like other unconventional pay periods, a fixed-length pay period is often seen in specific industries like education. People in this field work for ten months instead of 12, so they’ll need to calculate their payroll accordingly.

In some instances, regulations require employers to offer employees flexibility on how they want to be paid. Back to the education example, teachers are often given the option to receive payments over the ten-month school year or spread out across all twelve months.

How to calculate pay periods

Calculating pay periods is often a complicated task on one’s to-do list. However, the process of calculating payments is pretty straightforward. All you have to do is follow the steps below to calculate the payment due:

- Step 1. Outline the start and end dates of your pay period and create a payroll calendar.

- Step 2. Determine the days or hours employees work during the specified period.

- Step 3. Calculate the gross employee pay by multiplying your daily or hourly wage rate by the days or hours worked.

- Step 4. Subtract agreed-upon amounts in employee agreements from the gross payment, such as EOBI, health insurance, and other benefits.

- Step 5. Subtract taxes from the amount calculated.

Following the aforementioned steps will help you effortlessly calculate the pay periods and pay employees hassle-free.

What happens when there is an extra pay period?

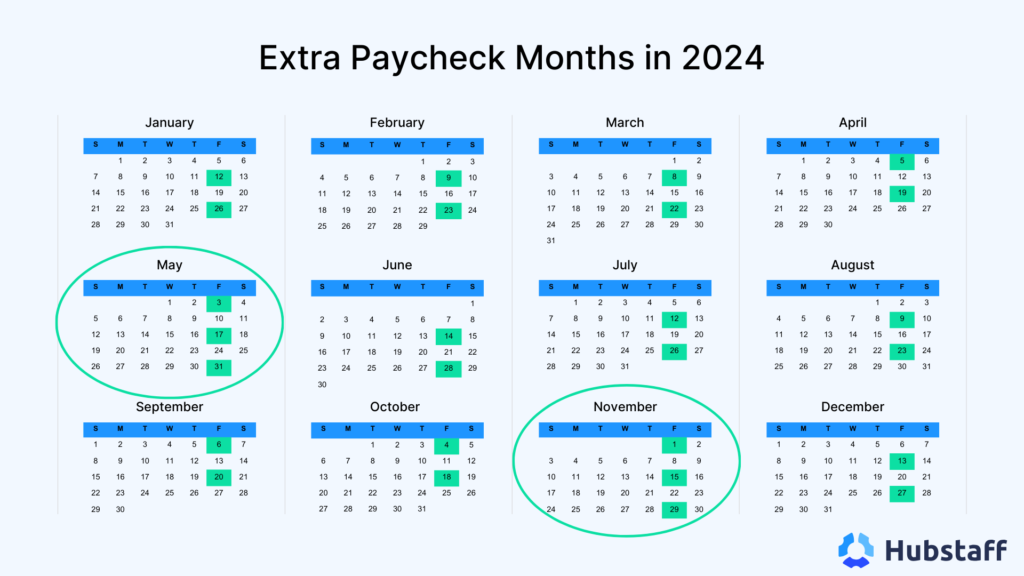

There are some instances in which you may acknowledge an extra pay period in a given year. This generally occurs when your company follows a weekly or biweekly payment structure.

A company that follows a weekly or biweekly payment schedule generally issues paychecks on Fridays. However, there are a few exceptions, such as the total number of Fridays in a year, which is 53.

This was seen in the year 2021, in which the first day of the year was a Friday, and the phenomenon will occur again in 2027.

Calculate pay periods and payroll with Hubstaff

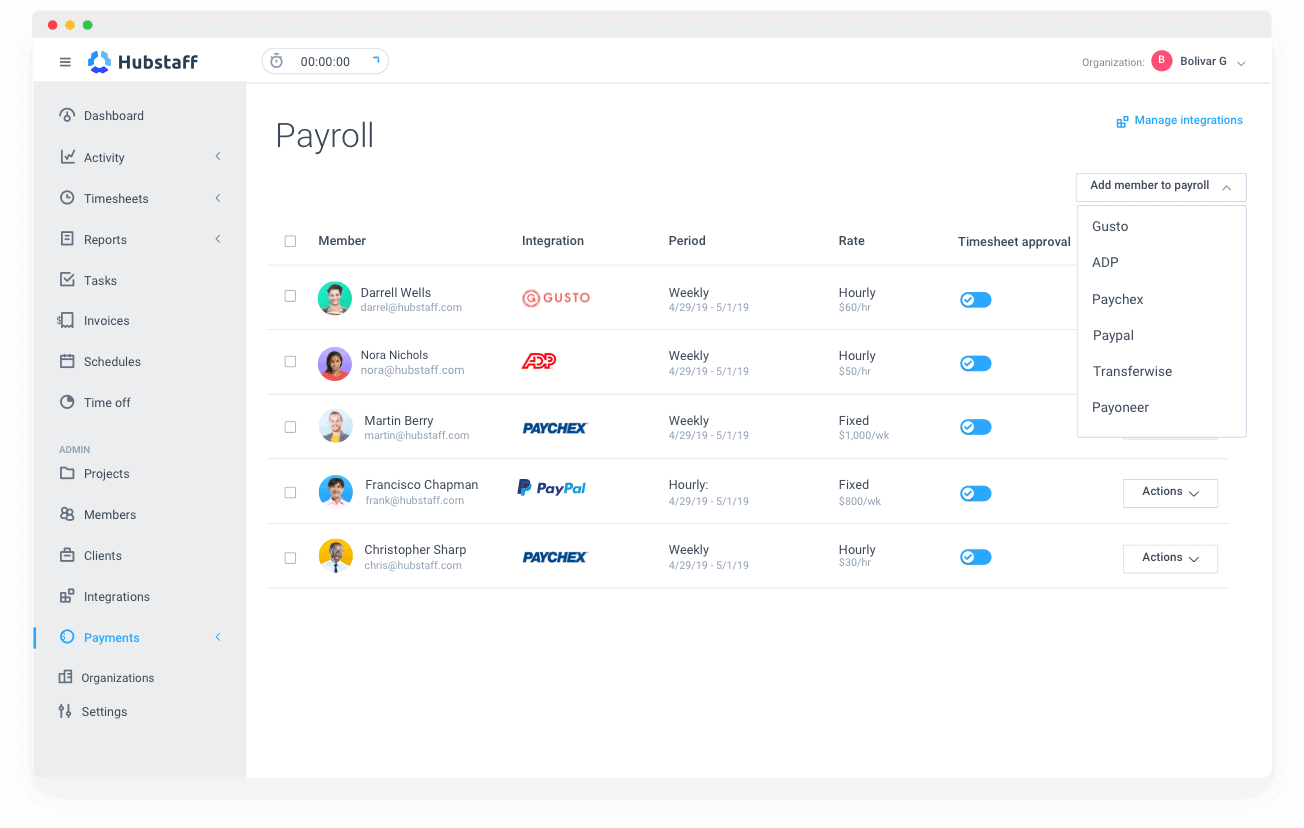

While calculating pay periods can be done manually, what happens when you have workers who need to be paid at varying frequencies? What about instances where preferred payment platforms vary as well?

Enter Hubstaff. With a versatile payroll system that integrates with an array of top providers like PayPal, Wise, and Gusto, you can pay your team on their terms.

Detailed reports, invoicing, and productivity features round out a workforce management system to keep you on top of year-round payroll needs.

Final words

This post explains everything you need to know about pay periods and helps you calculate them effortlessly, taking different factors into account. If you’ve had any confusion regarding the pay periods or payroll calculations, going through this guide may help you find answers to your questions.

Remember, the number of pay periods in a year depends on the payment frequency you choose — and that depends on choosing the right payroll schedule for your organization.

Further read:

Most popular

The Fundamentals of Employee Goal Setting

Employee goal setting is crucial for reaching broader business goals, but a lot of us struggle to know where to start. American...

Data-Driven Productivity with Hubstaff Insights: Webinar Recap

In our recent webinar, the product team provided a deep overview of the Hubstaff Insights add-on, a powerful productivity measurem...

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...