Just like the old saying goes, honesty really is the best policy — especially when it comes to filling out your timesheet. Timesheet fraud has severe legal and financial consequences for businesses and employees.

How significant of an issue is time theft?

A recent study by Deputy found that the average employee steals around 4.5 hours per week from their employer. Of course, this issue is not quite as nefarious as it sounds. Some people do this accidentally, while others just slightly blur the numbers. Still — these costs add up.

Managers can prevent timesheet fraud by implementing regular audits and using time tracking tools with secure features. But, more importantly, they should establish a relationship of trust and transparency with their team.

In this article, we’re diving into the topic of timesheet fraud. We’ll uncover its risks and share practical strategies to protect your business from this sneaky practice.

Boost your team’s efficiency with Hubstaff's productivity tools

What is timesheet fraud?

Timesheet fraud is when someone dishonestly alters the recorded hours worked on a timesheet for personal gain or to misrepresent their work. This dishonest practice can be done by employees and employers alike and is more common than you might think.

How much does timesheet fraud cost?

The American Payroll Association estimates that time theft costs businesses around 1.5% to 5% of their gross payroll annually. This theft adds up to hundreds of billions of dollars annually — a staggering number that business owners should know but not hyper-focus on.

Another study by the American Payroll Association reported that more than 75% of companies lose money from buddy punching, a practice where one employee clocks in for another.

Of course, the cost of timesheet fraud varies widely from industry to industry and depends mainly on businesses’ strategies to prevent timesheet fraud. We’ll get into those strategies later, but first, let’s explore the most common types of timesheet fraud.

Common forms of timesheet fraud

If you’re like most people, you’re wondering why and how employees are defrauding their managers and costing their company money for work that isn’t accurate or performed. The truth is that most people don’t purposefully commit timesheet fraud.

We’re not here to tell you that employee fraud is an everyday occurrence or that the majority of your team is being sneaky, but there are some things you should be on the lookout for.

Time theft by employees

- Timesheet tampering: Timesheet tampering is when an employee alters or falsifies recorded hours on a timesheet.

- False reporting of hours worked: False reporting of hours worked differs slightly from timesheet tampering because this is the incorrect input of data rather than changing already entered data.

- Buddy punching: Buddy punching is when an employee asks another co-worker to clock them in or out for their shift.

- Conducting personal business on the clock: Taking personal calls, browsing social media, and answering emails for your side gig are all examples of time theft. Most people are guilty of this offense to a small extent, but it can be a problem for businesses when it becomes a regular occurrence.

- Taking unauthorized breaks: Like conducting personal business on the clock, taking unauthorized breaks is another example of time theft that most are occasionally guilty of. The critical thing to note is that there is a difference between getting up and refilling your coffee and taking a dozen unauthorized breaks daily.

Time theft by employers

Now, let’s look at the other side of timesheet fraud. Remember, time theft is a two-way street, and employers are guilty of this offense, too.

- Mismanaging overtime: Employers occasionally neglect to compensate employees for overtime hours or fail to track and record overtime accurately. We’ll talk about the legality of overtime below.

- Paying less than minimum wage: When employers pay their employees below the legally mandated minimum wage for their work, this is a clear-cut example of time fraud, not to mention blatantly disregarding employment laws.

- Contacting employees outside of work hours: When employers frequently contact their employees during non-working hours, this blurs the lines between work and personal time and could be considered time theft.

- Misclassifying employees: Some employers categorize team members as independent contractors to refrain from providing benefits and protections permitted to employees under labor laws. Misclassification is a gray area for time theft, but it clearly falls under the umbrella of unfair labor practices that cost employees.

As you can see, time theft is complicated. It depends on company policies and employee honesty, and there are a lot of moral gray areas.

The law, on the other hand, is black and white.

The illegality of time fraud

The cost of timesheet fraud goes beyond corporate earning statements. There are legal ramifications for employees and employers who are guilty of time theft practices.

First, let’s answer the big question we’re all wondering.

Is falsifying time sheets a violation of the law?

Yes, falsifying time sheets is typically considered a violation of the law, especially if it involves altering accurate records related to employee hours worked or wages and benefits earned. Whether an employer or employee does this, it is unlawful.

The first step to understanding timesheet fraud consequences is to know the regulations surrounding employee time and benefits. We can’t give legal advice, but we can compile laws you should know regarding timesheet fraud.

- Fair Labor Standards Act (FLSA): The FLSA establishes federal minimum wage, record-keeping requirements, and child labor standards in the United States.

- See the FLSA Overtime Guide for information on overtime regulations in the US.

- See the FLSA Overtime Guide for information on overtime regulations in the US.

- Family and Medical Leave Act (FMLA): The FMLA gives eligible employees in the US job-protected leave for specific family and medical reasons.

- State labor laws: Each state could have a unique set of labor laws and other employment-related regulations in the US.

- Internal Revenue Service (IRS) regulations: The IRS has clear tax withholding, reporting, and recordkeeping regulations that employers in the US must follow.

- Worker classification guidelines: Employers in the US must follow IRS criteria for determining whether to classify team members as employees or independent contractors.

If you’re questioning any of these regulations, it’s time for a bit of light reading to understand how these laws apply to your business. Or, better yet, consult with a tax professional or legal expert to ensure you comply with all laws and regulations.

Why time theft is an issue

To understand how to prevent time fraud, we should take a minute to understand why it’s happening. Your average employee or business owner isn’t setting out to defraud anyone, so why is time fraud such a pervasive problem?

- For employees, time theft can be due to unclear policies and miscommunication from leadership. If employees aren’t clear on how and when to take breaks, they might commit time theft accidentally. Overworking and burnout can also lead to time theft out of necessity or by accident.

- For employers, labor is one of the most considerable costs for businesses. Companies barely scraping by might blur numbers to keep labor costs down. And, like employees, there might be occurrences where miscommunication and misunderstandings can lead to time theft.

Of course, none of this is to say we agree with time theft. Still, it is a more complex issue than just assuming sneaky employees are trying to trick companies out of their money.

Understanding the reasons behind time theft can help you take steps to prevent it.

Key strategies to avoid timesheet fraud

Here are some effective methods to detect and deter fraud, all relating to our fundamental goal: building trust and improving your internal time tracking process.

1. Practice trust and transparency

We understand that encouraging you to trust your team after informing you that they might be stealing from you is alarming. But hear us out.

The key to avoiding timesheet fraud is mutual trust and transparency. Trust works both ways; employees are more likely to be honest and responsible when they feel trusted and know what you expect.

While the concept of trust may seem daunting in light of potential fraud, it is a foundational element of every business. It must be in place before establishing policies, investing in software, or working on your company culture.

2. Evaluate company culture

Once you’ve worked to instill trust in your team and created transparent policies, it’s time to investigate your company culture. Every team works differently. Before establishing policies around time theft, you must understand how your team works best.

Company culture isn’t just ping-pong tables and early-out Fridays; it’s about setting a precedent for work-life balance and productivity.

Send out some employee surveys or communicate on Slack with your team and find out what makes them most productive. You might find that instilling regular coffee breaks or time to work out in your company culture is the difference between happy, productive employees and a burnt-out, stressed team.

Boosting employee morale is always worth going the extra mile to learn what your team needs from you as a leader.

3. Set clear expectations

Now that you’ve built a baseline of trust and a culture that embraces your team’s quirks, you should determine what your organization considers time theft.

Communicating expectations can help reduce accidental time theft and clearly define what is acceptable. Every company is different, so you should be careful when creating your time theft policy.

Here are some examples of elements to consider:

- Employees must clock in and out using time tracking software at the beginning and end of their shifts.

- If a break is longer than 15 minutes, employees should clock out.

- Core work hours are 9 am-5 pm CST.

- Employees should refrain from using personal devices during work hours, except in emergencies.

By openly communicating expectations and demonstrating trust in your team’s integrity, you promote ethical conduct and develop a sense of responsibility and employee loyalty.

4. Use time tracking technology

Once you’ve done the first three steps, consider using technology to track time and productivity. Time tracking software for employees will help you validate time tracking data and ensure it isn’t easy to manipulate without proper permission.

Simple time tracking tools are great for small teams, but if you manage over a few employees, you will need workforce management software.

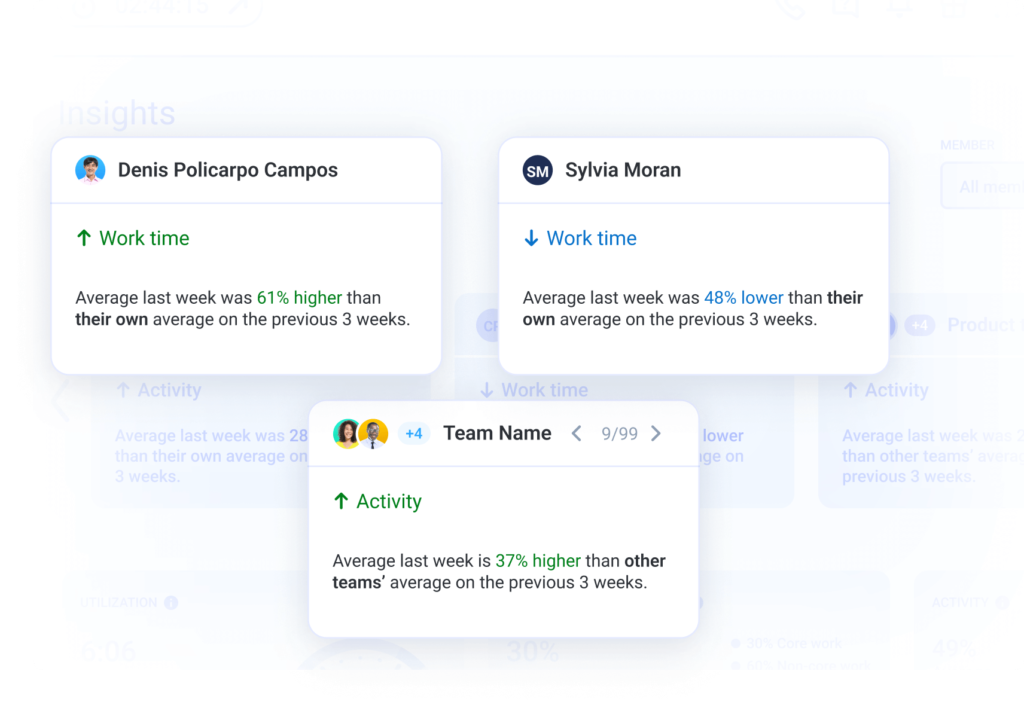

Workforce management tools like Hubstaff can help you:

- Say goodbye to manual timesheets with easy-to-use time tracking

- Get productivity Insights to fight burnout

- Send out payroll automatically based on timesheet data

- Automate timesheet reporting

- Improve employee experience by adding context to workforce data

Take the first step in preventing time fraud

While time theft poses a common challenge, it’s certainly not unbeatable. Reviewing and enhancing your workplace culture, policies, and time tracking tools might seem daunting initially. But the rewards, both in terms of productivity and finances, will be significant in the long term.

The best part? You don’t have to embrace authoritative methods. Building trust among employees is the first step.

Further read:

Most popular

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...

The AI Productivity Panel: Lessons From Leaders on What’s Working (and What’s Not)

When I moderated this AI productivity panel, I expected a solid conversation. What I didn’t expect was the flood of real-world i...

Employee Performance Dashboards: Templates, Tools, and Best Practices

Keeping track of how your team’s really doing can be tricky. Spreadsheets pile up, one-on-ones only tell part of the story, and...

![How to Use Time Blocking to Make 2024 Your Most Productive Year Ever [Free Template]](https://hubstaff.com/blog/wp-content/uploads/2018/12/time-blocking@2x-780x390.png)