The contractor vs. employee debate is a defining crossroads for those at the helm of significant business decisions.

How important is the decision between hiring employees vs contractors? In our opinion, it is critical. This decision will shape your company’s trajectory and set the tone for its culture, structure, and success.

This isn’t our first rodeo: At Hubstaff, our team comprises a mix of employees and contractors who work remotely. As a result, we know all about the benefits and pitfalls of hiring new team members as contractors or employees.

Whether you’re leading a startup or an established business, our exploration of contractors versus employees will equip you with the wisdom needed to make informed choices that align with your company’s vision and objectives.

This article can serve as your guide, offering practical insights and knowledge to guide your decision-making process.

- Defining the difference between contractors and employees: a direct comparison

- Employee vs. contractor: Factors to consider

- Pros and cons of hiring employees vs. independent contractors

- How to decide between hiring employees and contractors

- Case study in deciding on contracting vs. employment

- FAQS: Hiring contactors vs. employees

- Key takeaways

Boost your team’s efficiency with Hubstaff's productivity tools

Defining the difference between contractors and employees: a direct comparison

Running short on time? Here’s the big-picture information that you need to know.

| Contractors | Employees | |

| Payment | Typically paid on a project basis or hourly. Payment structure can vary based on the contract terms. | Usually paid a salary or hourly wage with regular, predictable paychecks. |

| Benefits | Often lack traditional employment benefits such as health insurance, retirement plans, and paid time off. They may need to manage their own benefits. | Eligible for various benefits like health insurance, retirement plans, paid time off, and sometimes additional perks. |

| Taxes | Responsible for handling their own taxes, including income and self-employment taxes. | The employer typically withholds taxes, simplifying the tax process for employees. |

| Flexibility | More flexibility in terms of work hours and project selection. May work for multiple clients simultaneously. | Follow a fixed work schedule and may have limited flexibility, but job security is higher. |

| Job security | Generally have less job security and may face contract non-renewal or termination after a project’s completion. | Tend to have more job security, often with the expectation of ongoing employment. |

| Training and development | Typically responsible for their own professional development and career growth. | Often receive training, career development, and opportunities for advancement within the organization. |

What is an independent contractor?

Contractors are individuals (or sometimes companies) who work independently and are responsible for their own taxes, insurance, and benefits. Typically, contractors have specialized skills or expertise that businesses need for specific projects.

They often work on a project basis, with the contract ending after the project. Contractors also have the right to refuse work, negotiate their fees, and work with a variety of clients at the same time (unless their contract specifies otherwise).

What is an employee?

Employees are individuals who work for a company regularly. They are generally hired to perform specific job duties and are governed by company policies and procedures. Employees are usually provided with a workspace, equipment, materials, and training and are paid hourly wages or salaries.

In addition, employers are responsible for withholding and paying employees’ taxes, social security, and insurance and must comply with labor laws and regulations.

Employee vs. contractor: Factors to consider

From an employer’s perspective, deciding between hiring an employee or a contractor hinges on several critical factors that can significantly impact the workforce composition and, by extension, the business’ trajectory.

It’s a decision transcending mere job titles — choosing the right workforce composition to propel your business forward.

Payment

Contractors: Contractors are often paid based on the terms specified in their contract, offering a versatile payment structure ranging from fixed project fees to hourly billing. While this flexibility can be advantageous, it places the responsibility of managing income (including tax obligations and retirement savings) squarely on the shoulders of contractors.

Employees: In contrast, employees typically receive predictable and regular paychecks, whether salaried or hourly. This steadiness simplifies financial planning and budgeting. Employers are responsible for withholding taxes and handling payroll-related tasks.

Benefits

Contractors: Contractors frequently lack access to traditional employee benefits such as health insurance, retirement plans, or paid time off. Procuring these benefits becomes the contractor’s responsibility, often entailing added costs and careful consideration.

Employees: Employees generally enjoy various employer benefits, including health insurance coverage, retirement plans (like 401Ks), and paid time off. These benefits enrich the overall compensation package and offer a sense of security.

Tax Responsibilities

Contractors: Contractors are classified as self-employed and assume the obligation of managing their taxes. This encompasses paying income tax and self-employment tax and navigating deductions and credits.

Employees: Employees experience the convenience of their employer’s tax withholding, streamlining the process. Employers also contribute to Social Security and Medicare taxes on behalf of their employees.

Legal considerations

Contractors: The legal obligations differ for contractors, as they are generally responsible for their own taxes and do not receive employee benefits. However, incorrect classification of an employee as a contractor can lead to serious legal consequences, including fines and back pay, making it essential to accurately determine the correct status under labor laws.

Employees: Legally, hiring employees requires businesses to comply with labor laws, including minimum wage, overtime pay, and tax withholding obligations. Employers must also adhere to regulations surrounding employee rights, benefits, and workplace protections.

Flexibility

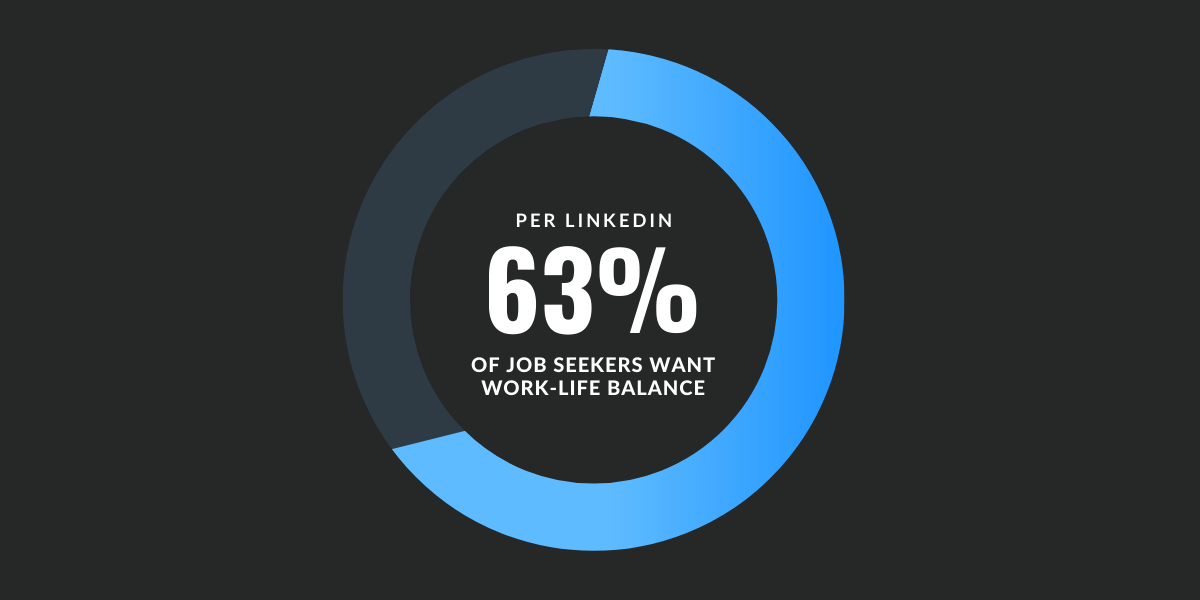

Contractors: Contractors often have more flexibility for work hours and project selection. They can juggle multiple clients simultaneously, granting them autonomy in managing their work. The flexibility and work-life balance that contract work enables is also one of the reasons individuals may seek contract positions.

Employees: In contrast, employees typically adhere to a fixed work schedule dictated by the employer, which may offer limited flexibility. However, this arrangement often provides a higher level of job security and stability.

Job security

Contractors: Job security for contractors is often more tenuous, with contracts subject to non-renewal or project terminations. This dynamic necessitates a continuous pursuit of new work opportunities.

Employees: In contrast, employees typically enjoy greater job security, with the expectation of ongoing employment contingent on performance and economic factors. However, there are numerous employment-at-will states in the U.S. where employees can be terminated without notice.

Training and development

Contractors: Contractors are primarily responsible for their professional development and career growth. They must proactively invest in training, buying their own equipment, and skill development.

Employees: Employees often benefit from structured training, career development opportunities, and the potential for advancement within the organization. Employers typically support their growth through well-defined programs.

Employers must weigh these factors carefully when deciding whether to hire contractors or employees to align their workforce composition with their business goals and operational requirements.

Pros and cons of hiring employees vs. independent contractors

Choosing between contractors and employees is a pivotal decision shaping your workforce and business. Each option has its advantages and disadvantages. We’ll look at the benefits of hiring a contractor vs employee and some of the concerns.

Let’s explore the dynamics of hiring contractors versus employees, helping you make informed decisions that align with your business needs.

Hiring a contractor: pros and cons

| Pros | Cons |

| Flexibility: Contractors provide flexibility in work arrangements and hours, making it easier to adapt to project scope. | Limited loyalty: Contractors may not have the same level of commitment to the organization as full-time employees. |

| Specialized skills: Contractors often bring specialized expertise, and you can hire them for specific projects that require these skills. | Less control: You may also have less control over the work and schedule of contractors, as they often work remotely or independently. |

| Cost control: Contract employees are typically paid for specific projects so that you can control project costs. | Project-based: Contractors are typically hired for specific projects and may not be available for ongoing work. |

| Reduced overhead: Contractors are responsible for their benefits and taxes, reducing your overhead expenses. | Legal complexity: Misclassifying contractors can lead to legal issues, so it’s essential to understand and follow labor laws. |

| Scalability: You can quickly scale your workforce up or down by hiring or releasing contractors as needed. |

Hiring an employee: pros and cons

| Pros | Cons |

| Dedication: Employees often firmly commit to the organization and its long-term goals. | Higher costs: Employing full-time employees involves higher costs, including benefits, taxes, and salaries. |

| Team integration: Employees can become an integral part of the team, fostering a sense of belonging and collaboration. | Limited flexibility: You may have limited flexibility regarding workforce scalability and project-specific skills. |

| Consistency: Full-time employees provide consistent, reliable availability for ongoing work. | Training: Employees may require more training and onboarding, adding to initial costs and time. |

| Benefits: Employees are typically eligible for health insurance, retirement plans, and paid time off — incentives that can help companies attract top-tier talent. | Administrative overhead: Managing employee benefits, payroll, and compliance can increase administrative tasks. |

| Legal obligations: Hiring employees comes with legal obligations, such as compliance with labor laws and regulations. |

Hiring a contractor or employee should align with your business needs, project requirements, and organizational goals.

How to decide between hiring employees and contractors

This guide will walk you through the essential steps to help you make an informed decision that aligns with your business needs and compliance requirements.

Step 1: Assess the nature of the work

Consider the type of work that needs to be done. An employee might be the better fit if the role requires ongoing, long-term tasks with consistent hours and direction. Conversely, hiring a contractor could be more appropriate if the work is project-based, temporary, or requires specialized skills for a limited time.

Step 2: Evaluate control and independence

Determine how much control you need over the work. Employees typically operate under strict supervision with defined schedules and procedures. An employee is usually necessary if you need to maintain control over how the work is performed. Contractors, on the other hand, have more independence and typically control how, when, and where they work, following the contract terms.

Step 3: Consider legal and financial implications

Employees must comply with labor laws, including benefits, tax withholding, and workplace regulations. Contractors, while more flexible, don’t have these obligations, but misclassification can lead to legal and financial penalties. Weigh compliance costs against the flexibility and potential savings of hiring a contractor.

Step 4: Review long-term business needs

Think about your business’s long-term requirements. Hiring an employee could be more beneficial if you anticipate a sustained need for the role with growth opportunities. Contractors are a practical choice for short-term needs or specific expertise that doesn’t warrant a permanent position.

5. Consult legal and HR experts

Before making a final decision, consult with legal and HR professionals to ensure you fully comply with relevant labor laws. They can provide guidance on classification, contracts, and the potential risks associated with each option.

Case study in deciding on contracting vs. employment

The case for employees

Let’s bring this into the real world and consider a case study where a tech company must decide whether to hire an employee or contractor for their new hire.

A tech startup specializing in remote project management tools faced a decision about whether to hire an employee or a contractor for its new software development project.

The project required ongoing updates, bug fixes, and feature development—critical tasks for the company’s product roadmap. After evaluating the continuous nature of the work, the need for close collaboration with the internal team, and the long-term business goals, the startup opted to hire a full-time software developer.

This decision ensured consistent quality, allowed greater control over the development process, and aligned with the company’s strategic growth plans. By choosing an employee, the startup could invest in talent that would grow with the company, providing stability and expertise crucial to their success.

The case for contractors

A mid-sized e-commerce company needed to boost its online presence with a series of targeted ad campaigns. However, the in-house team lacked the specialized expertise in digital advertising.

The company evaluated its options and decided to hire a contractor with a proven track record in running successful ad campaigns for similar businesses. The project was time-sensitive and required a specific skill set that wasn’t needed on an ongoing basis. The company avoided the long-term commitment and overhead costs of hiring a full-time employee by choosing a contractor.

The contractor delivered the campaigns on time, significantly increasing the company’s online sales and allowing the in-house team to focus on core operations. This decision provided the flexibility and expertise the company needed without the long-term financial commitment.

FAQS: Hiring contactors vs. employees

What is the difference between a contractor and contracting?

A contractor is an individual or business hired to perform specific tasks or projects for a company, usually under a contract agreement. Contracting, on the other hand, refers to the process of hiring or engaging contractors to complete particular work. While a contractor is a person or entity providing the service, contracting is the broader practice or process of forming these agreements.

What is the meaning of contracting in jobs?

Contracting in jobs refers to hiring individuals or businesses on a contractual basis, usually for a specific period or project. Unlike traditional employment, contracting doesn’t involve long-term commitments or benefits like health insurance or retirement plans. Contracting is often used for specialized tasks, temporary projects, or when flexibility is required.

How does the hiring process differ between employee and contractor?

Hiring an employee involves a more formal process, including interviews, background checks, and onboarding, focusing on long-term fit and alignment with company culture. In contrast, hiring a contractor is often more straightforward, focusing on the contractor’s ability to complete a specific task or project.

Key takeaways

Whether to hire a contractor or employee is essential for any business owner. Understanding the differences between contractors and employees and evaluating the nature of the work can help you make the right choice.

Both types of team members have advantages and disadvantages, so evaluating your business’s specific needs and goals is essential.

Sometimes, hiring a combination of contractors and employees may be best to achieve optimal results and maximize your business’s efficiency and success.

Utilizing workforce management tools can be an essential component of your business’ success — especially when employing a combination of employees and independent contractors.

Workforce management software can help you:

- Track time and productivity

- Manage payroll

- Request time off and schedule shifts

- Create invoices

- Build detailed reports

In navigating this decision, we recommend seeking legal counsel or consulting with human resources professionals to ensure compliance with labor laws and regulations. Your choice should also reflect your unique business needs, and by making an informed decision, you can propel your organization toward a more productive future.

Most popular

The Fundamentals of Employee Goal Setting

Employee goal setting is crucial for reaching broader business goals, but a lot of us struggle to know where to start. American...

Data-Driven Productivity with Hubstaff Insights: Webinar Recap

In our recent webinar, the product team provided a deep overview of the Hubstaff Insights add-on, a powerful productivity measurem...

The Critical Role of Employee Monitoring and Workplace Security

Why do we need employee monitoring and workplace security? Companies had to adapt fast when the world shifted to remote work...

15 Ways to Use AI in the Workforce

Whether through AI-powered project management, strategic planning, or simply automating simple admin work, we’ve seen a dramatic...